Understanding ESG Materiality & its Importance in Sustainability Reporting

In a recent PwC survey, 76% of consumers said they would cease associating with brands and companies that treat employees, communities, and the environment poorly. Growing consumer awareness of environmental, social, and governance (ESG) components demands more actions towards ESG materiality assessments from businesses. ESG materiality assessments are iterative and unique to every business and industry. They require organizations to pay close attention to intricate ESG factors or events that have implications on the financial or operating performance of their business. In the rest of this blog, let us unpack ESG materiality and understand why it matters in ESG reporting.

What is Materiality?

Materiality is accounting and auditing jargon. It loosely translates to any attribute of an organization that impacts investors’ decisions. Materiality includes information crucial for reporting and disclosure to investors or other stakeholders interested in a business’s financial statements. These days, sustainability is a significant part of the focus of investors and stakeholders. Therefore, it is necessary for businesses to disclose all information (financial and non-financial) related to their ESG practices.

In the context of ESG, materiality is a tool or metric used by a company or government to decide what ESG factors a business should report or consider for measuring ESG risks. According to the definition by the International Integrated Reporting Council (IIRC) and the International Federation of Accountants, ‘a matter is material if it could substantively affect the organization’s ability to create value in the short, medium and long term.’

Materiality helps a business assess what aspects of its ESG practices matter the most and how to improve its performance to avert ESG risks. It also helps a business disclose its ESG performance to investors, regulators, and stakeholders to foster trust and confidence and drive sustainable investments.

Why Materiality is Subjective and an Evolving Concept?

However, materiality is a dynamic and subjective concept relative to the industry laws, compliance laws, reporting regulations, nature of business, etc., Because ESG objectives and strategies vary from business to business. For example, a consumer-packed goods conglomerate would prioritize looking into material issues based on the latest consumption trends and expert opinions on end-users’ health, safety, wellness, and environmental impact. Whereas a clothing brand would investigate factors like the sustainability of its distribution and supply chain channels, marketing practices, and workforce health and safety.

Moreover, investors and shareholders would be interested in the enterprise value of the business. External stakeholders like consumers, not-for-profit, and humanitarian agencies would review short—and long-term health and environmental risks.

It mostly boils down to who the stakeholders are and what risks are material to them. What the stakeholders perceive as material may evolve with trends, needs, expectations, and opportunities.

Therefore, conducting an ESG materiality assessment helps understand what information is ‘material’ or important for reporting and disclosure. It is essential to keep up with recent ESG factors relevant to the business, its investors, and others and use them as a metric for calculating ESG risks.

What is Double Materiality?

Double materiality extends the materiality in sustainability reporting by including internal factors—sustainability impacts on a business and impact on external elements—and how a business’s actions affect society and the environment. That means businesses must investigate:

- ESG issues that have a financial impact.

- Operations, activities, and business events that negatively impact the environment and society at large.

Double materiality is the new disclosure requirement under the EU’s Corporate Sustainability Reporting Directive (CSRD), which mandates businesses disclose their financial and impact materiality. It became the norm for sustainability reporting for EU businesses on January 1, 2024. Double materiality assessments include identifying disclosure requirements listed in the European Sustainability Reporting Standards (ESRS) and are crucial for EU CSRD compliance.

What are Financial and Non-financial (Impact) Materiality?

For carrying out double materiality assessments under the CSRD, businesses need to consider:

Financial Materiality: ESG issues that influence a company’s financial performance, such as cost of capital, cash flows, investor funding, revenue growth, profitability, and cost savings, are considered financial material.

For instance, a manufacturing company discovers and implements new ways of recycling production waste for sustainability reasons. This reduces the cost of purchasing new materials for production. Their green manufacturing and sustainability best practices invite media and public attention, driving up sales from environmentally conscious consumers. Cost savings and profitability from sales are examples of financial materiality.

Impact or Non-financial Materiality: It refers to a company’s operations impact on stakeholders, communities, biodiversity, the environment, and society at large. For illustration, a food and beverage manufacturing business with carbon-intensive production plants and units practices unsafe toxic waste disposal, endangering the environment, biodiversity, and local communities.

Is Double Materiality Relevant for U.S. Companies?

While the concept of double materiality seems relevant to EU companies, U.S. companies are aware of the practice of materiality filing with the Securities Exchange Commission (SEC). During 2021, SEC Commissioner Hester M. Pierce addressed speculations of whether the commission will adopt the global ESG metric, stating, “The European concept of “double materiality” has no analogue in our regulatory scheme and the addition of specific ESG metrics, responsive to the wide-ranging interests of a broad set of “stakeholders,” would mark a departure from these fundamental aspects of our disclosure framework.”

The SEC’s Investor Advisory Committee panel discussion on March 06, 2024, recently concluded that the double materiality standard should not be included.

However, starting January 2028, the CSRD’s sustainability reporting requirements apply to subsidiaries of non-EU parent firms if:

- The company’s net turnover for two consecutive financial years is more than €150 million annually.

- The company has:

- EU brand with a net turnover of €40 million or

- If the subsidiary in the EU means one of the below requirements:

- Net turnover of over €50 million:

- Total assets worth over €25 million; and/or

- Has 250+ employees.

What are the impacts of ESG Materiality?

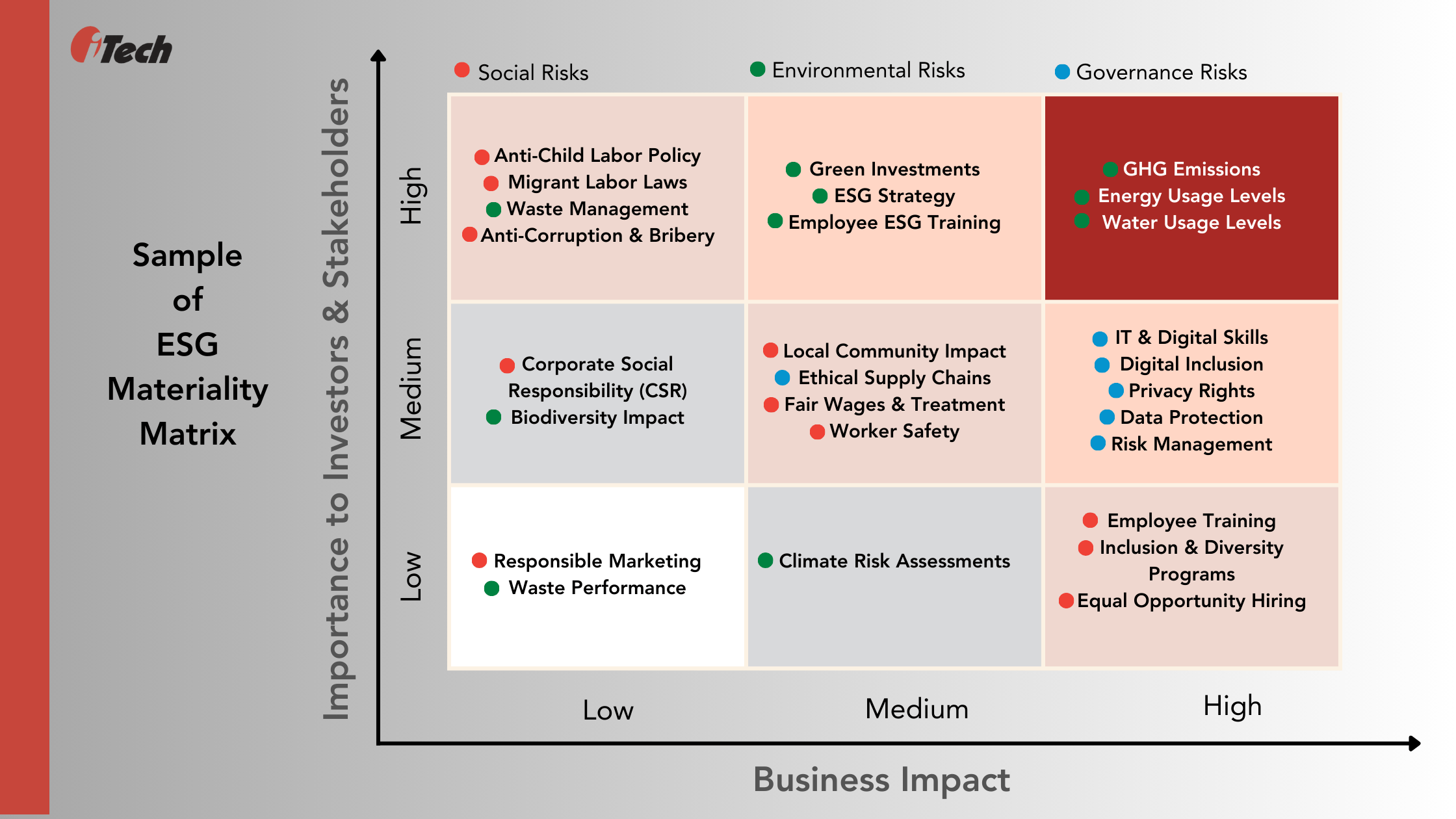

Companies often calculate ESG materiality through a risk matrix that helps determine potential risks, likelihood of occurring, and degree of risk impact. ESG materiality assessments impact businesses by assisting them in defining material factors, planning actions accordingly, and allocating resources to align their business with ESG principles. Current material risks, future priorities, and assessment reports are mostly communicated via annual corporate sustainability reports.

Most companies can use ESG materiality assessment as a risk management tool by proactively understanding the scope of risk impact on their brand reputation, profitability goals, and business prophecies. It helps them readjust risk prevention and resilience strategies.

Moreover, ESG materiality assessments help businesses enhance the trust and credibility of employees, investors, customers, government, and communities.

How to Conduct ESG Materiality Assessments?

According to the Harvard Law School’s 2022 ESG Global Study, 79% of investors agree that how a company manages its ESG risks influences their investment choices. And 76% refer to a company’s ESG risk and opportunity profile to assess potential investment plans. Now it’s clear that organizations have a good reason to conduct ESG materiality assessments, let us explore the steps for conducting ESG materiality assessments:

- Key Stakeholder Identification: Start by identifying internal (employees, board members, managers, senior executives, etc.) and external stakeholders (investors, suppliers, customers, regulatory authorities, local communities, and others).

- Establish ESG Scoring Criteria: Stakeholders mostly measure ESG issues based on their impact on the company or business over the next few years or how relevant those risks are to their values, beliefs, and expectations from the business. ESG materiality impact considers all financial consequences, operational risks, and brand reputation.

- Assessment of Quantitative and Qualitative Metrics: Define and combine quantitative metrics like financial and vital performance indicators with qualitative insights like stakeholder feedback, consumer expectations, industry trends, etc. GRC tools for ESG compliance streamline all the matrices, results, and more to derive objective insights.

- Prioritize with Scoring: Materiality is subjective to each organization, so companies must define scoring based on unique ESG materiality factors. Risks can be scored and prioritized based on importance or impact.

- Integrate with Sustainability Reports: To communicate and disclose ESG materiality assessments with the stakeholders through annual reports, organizations need tools to automate and integrate ESG scores and data into reports without manual errors and discrepancies.

Demystify Sustainability Compliance with iTech GRC

Businesses can leverage ESG ratings and compliance for competitive differentiation. Navigating evolving sustainability regulations and the expectations of new-age, environment-conscious customers can be challenging. Cutting-edge GRC solutions such as IBM OpenPages Risk Management facilitate effective compliance and holistic management of ESG programs.

At iTech GRC, our experts empower organizations to demystify and comply with the latest sustainability standards and build strategies for a sustainable future.

Connect with our experts to plan your GRC projects using OpenPages with Watson’s brand-new AI updates!