How to Manage ESG Compliance?

Managing ESG (Environmental, Social, and Governance) compliance has become a priority for companies worldwide. With approximately 90% of investors now considering ESG factors in their decision-making processes, the pressure to meet these standards is more significant than ever. If you need more clarification on what ESG entails, our earlier discussion on Understanding ESG explains what ESG reporting is, the challenges companies face in creating these reports, and why they are essential for sustainability.

Properly managing ESG compliance is not just about avoiding penalties. Instead, it is about gaining a competitive edge, enhancing operational efficiency, and fostering long-term growth.

A well-managed ESG strategy can significantly boost a company’s reputation, attract sustainability-focused investors, and ensure regulatory compliance. McKinsey also echoed this importance. It outlines that ESG initiatives can create value in multiple ways, including facilitating top-line growth, reducing costs, minimizing regulatory and legal interventions, increasing employee productivity, and optimizing investment and capital expenditures. Moreover, the SEC’s recent mandate on ESG reporting underscores companies’ need to integrate robust ESG practices into their core operations.

So, how can you manage ESG compliance effectively? Let’s explore some practical steps.

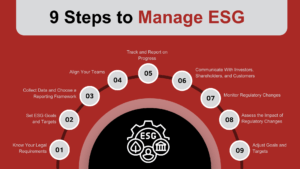

Steps to Manage ESG Compliance

Step 1: Know Your Legal Requirements

Begin by identifying the key legal obligations relevant to your business. Prioritize those with the closest deadlines to ensure timely compliance. Understanding these requirements is crucial because non-compliance leads to significant legal risks, financial penalties, and reputational damage. By clearly grasping your mandatory legal requirements, you lay a solid foundation for a structured ESG compliance strategy. This proactive approach helps you meet legal standards and demonstrates your commitment to responsible business practices, enhancing your organization’s reputation and trustworthiness in the market.

Step 2: Set Clear ESG Goals and Targets

Align your business priorities with the mandatory deadlines for ESG requirements by setting clear ESG goals with specific, measurable targets. These goals should help you comply with legal requirements and reflect your company’s commitment to sustainability. ESG goals encompass three main areas: Environmental, Social, and Governance.

- Environmental goals focus on reducing the company’s impact on the environment, such as lowering carbon emissions, minimizing waste, and conserving water and energy.

- Social goals address the company’s impact on people and society, including improving working conditions, promoting diversity and inclusion, supporting community projects, and ensuring the health and safety of employees and customers.

- Governance goals involve enhancing how the company is managed and governed, ensuring transparent and ethical business practices, having a diverse and independent board of directors, and implementing strong anti-corruption measures.

Setting these ESG goals ensures a cohesive strategy for ongoing improvement. It also demonstrates your dedication to responsible business practices and enhances your company’s reputation and trust in the market.

Step 3: Collect Data and Choose a Reporting Framework

Determine your data infrastructure needs by identifying ESG reporting requirements and necessary data points across various frameworks. Consistent and accurate data collection is essential for transparency and effective reporting. Utilize standardized frameworks like GRI, SASB, or TCFD to ensure your reporting meets industry benchmarks and regulatory standards.

Step 4: Align Your Teams

Achieving alignment across all stakeholder teams is critical to preventing unexpected ESG compliance issues. This includes seamless collaboration between departments such as product development, engineering, and supply chain vendors. Clear communication and shared goals help ensure that all parts of the organization work towards the same ESG objectives.

Step 5: Track and Report on Progress

Consolidate relevant data to monitor progress towards each ESG goal and related targets. Regular tracking enables timely adjustments and ensures that the organization stays on course. Effective reporting mechanisms should be established to provide clear, actionable insights into ESG performance.

Step 6: Communicate With Investors, Shareholders, and Customers

After collecting data, use ESG reporting frameworks to share your progress with investors, shareholders, and customers. ESG reporting frameworks are structured guidelines that ensure your ESG data is consistent, transparent, relevant, and accurate. These frameworks, such as the Global Reporting Initiative (GRI), the Sustainability Accounting Standards Board (SASB), and the Task Force on Climate-related Financial Disclosures (TCFD), help make your information comparable and reliable.

Regular and transparent reporting builds trust and shows your commitment to sustainability and ethical practices. This transparency is crucial for maintaining stakeholder confidence and attracting new investors, as it demonstrates your dedication to responsible business practices and allows stakeholders to make informed decisions based on your company’s ESG performance.

Step 7: Monitor Regulatory Changes

The ESG regulations are continuously evolving. Regularly monitoring for updates ensures that the company complies with all legal requirements. Staying informed about new regulations helps in timely adjustments to the ESG strategy, avoiding potential compliance risks.

Step 8: Assess the Impact of Regulatory Changes

Evaluate and interpret new regulatory updates to understand their impact on the company’s ESG obligations. This involves assessing how changes affect current practices and what adjustments are necessary to maintain compliance. Proactive assessment helps in smooth transitions and continuous compliance.

Step 9: Adjust Goals and Targets

Regularly revisit and refine your ESG goals and targets based on regulatory updates and performance assessments. This iterative process ensures that the ESG strategy remains relevant and effective in achieving long-term sustainability objectives. Continuous improvement is key to maintaining a robust ESG compliance framework.

Achieving ESG Excellence with Strategic Management

Effectively managing ESG compliance is an ongoing journey that requires a strategic approach, robust systems, and continuous adaptation to regulatory changes. By following these steps, companies can ensure they meet regulatory requirements while leveraging sustainability as a strategic advantage. This comprehensive approach will not only help maintain compliance but also drive innovation and long-term value creation.

At iTech, an IBM OpenPages partner, we specialize in helping businesses navigate the complexities of ESG compliance. Our expertise and advanced solutions can help your company achieve its ESG goals and maintain robust compliance practices. Ready to take your ESG strategy to the next level? Contact us today, and let’s start the journey together.

Do you have thoughts on ESG compliance or tips to share? Please drop a comment below. We’d love to hear from you!