Time to Re-evaluate Corporate Actions: Six Corporate Governance Trends in 2024

Corporate governance frameworks are vital for demonstrating a company’s ethical practices and values while balancing stakeholders’ and community interests. 2024 is filled with events that have made corporate entities perpetual targets for ethical and sustainability activism and regulatory scrutiny. As we close the mid-third quarter of the year, it’s time to revise your organization’s strategies and framework and strategies by keeping up with the six corporate governance trends in 2024!

We have already reviewed the ten recommended steps to improve corporate governance. This blog reflects on recent developments to help corporate executives and board leaders introduce thoughtful corporate approaches pertinent to long-term business performance.

Evolution of Governance Models in Corporate America

Anywhere around the world, corporate governance is a dynamic concept. It is best defined as a company’s management, board, and shareholders’ responsibility toward legal, regulatory, competitive, democratic, and ethical obligations.

In the U.S., corporate governance evolved from the entrepreneurial capitalism model, in which a handful of wealthy companies (J.P. Morgan, Rockefeller, Carnegie, Ford, and DuPont) had both ownership and control rights. Eventually, corporations adopted the managerial capitalism model, in which the equity owners or shareholders no longer exercised control. Instead, it was delegated to hired managers and professionals.

During the twentieth century, institutional investors collectively owned more than 50% of the outstanding equity of more than 1,000 companies, acting as their fiduciaries. They were legally required to demonstrate their loyalty and integrity and focus on the interests of their beneficiaries (shareholders, employees, society, environment, and community). The fiduciary capitalism model applies to current times. The fiduciary duty definitions have undergone legislative revisions because of several corporate scandals to hold entities accountable for their actions and oversights.

21st Century Corporate Governance Regulations

The dramatic Enron bankruptcy, the 2008 financial debacle, and the recent First Republic, SVB, and Signature Bank meltdown are labeled as corporate governance failures. These events also introduced regulatory reforms and legal penalties against board oversight and corporate behaviors.

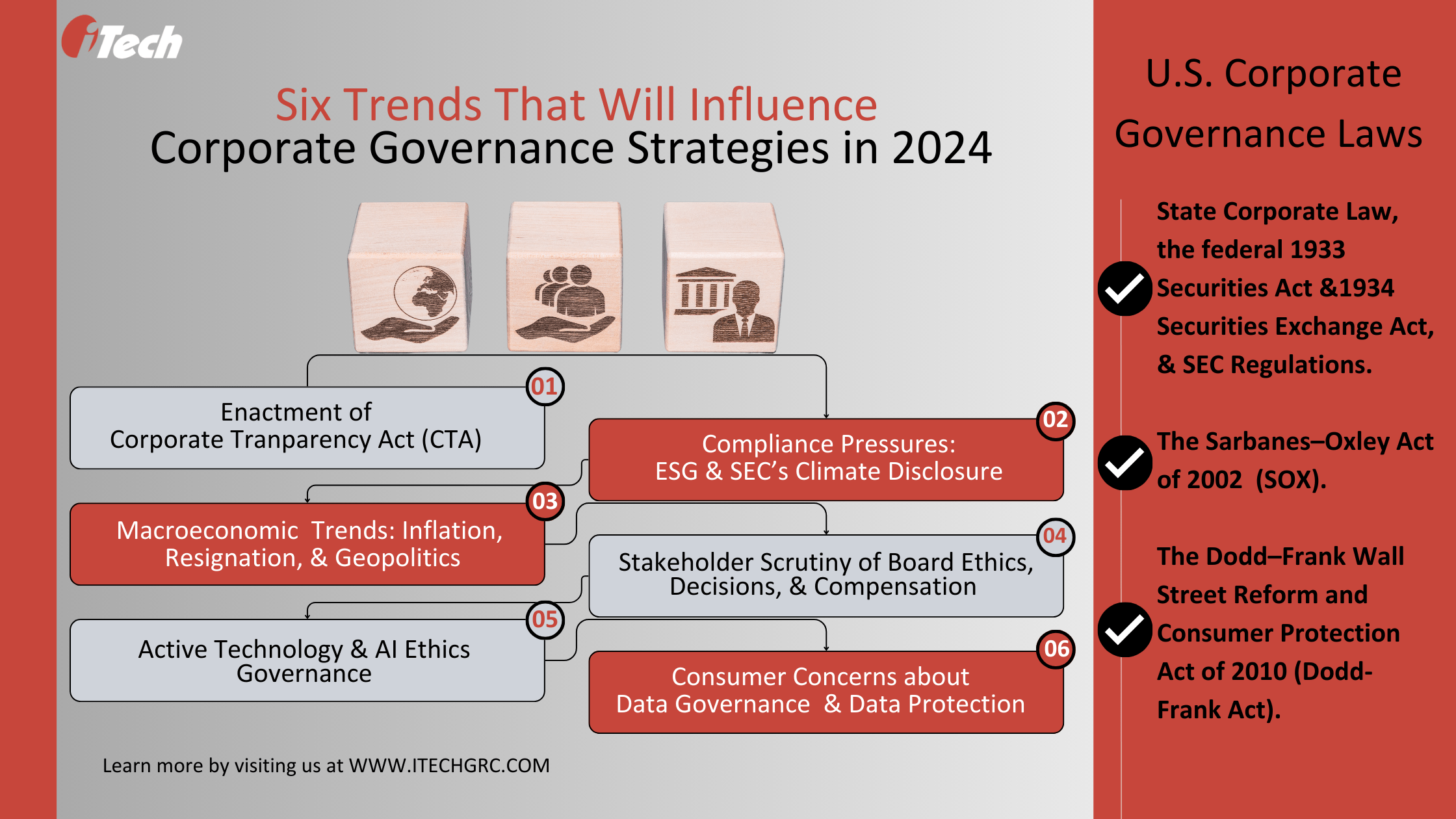

Corporate governance laws in the country are enforced by the U.S. Securities Act of 1933, the U.S. Securities Exchange Act of 1934, the Securities Exchange Commission (SEC), and federal and state rules governing specific areas of corporate practices.

The Sarbanes Oxley Act was enacted in July 2002 as a response to 21st-century corporate failures and frauds. It created requirements for corporate audit practices that must be reviewed by external auditors.

The Dodd-Frank Wall Street Reform and Consumer Protection Act, also known as the Dodd-Frank Act, was passed in July 2010 as a follow-up to the 2008 crisis. Over the years, the SEC has also made several changes and rule amendments related to disclosures for standardization.

Six Critical Corporate Governance Trends in 2024

Acknowledging and embracing dynamism is the only way to keep up with the times. This means updating your firm’s corporate governance practices to foster transparency, accountability, and integrity while ensuring strong internal controls, stakeholder engagement, and regulatory compliance.

Here’s a rundown of corporate governance trends in 2024:

1. Introduction of Corporate Transparency Act: The Corporate Transparency Act (CTA) was introduced on January 1, 2024, to curb illicit financial activities, money laundering, and unethical business practices. The CTA mandates companies to disclose their beneficial owners and controllers to the Financial Crimes Enforcement Network (FinCEN), a bureau of the United States Treasury.

The regulation also recommends ownership interest assessments to identify a reporting company’s beneficial owners and outline who is exempt from its reporting requirements. Non-compliance, non-disclosure, or false reporting of ownership information will lead to criminal penalties and fines.

2. Increased Pressure for ESG & SEC Compliance: More customers and shareholders demand transparency into brands’ and businesses’ carbon footprint and ESG practices. Sustainability is baked into funding and investment strategies. To ensure green investments and sustainability are not just eyewash, the SEC’s Climate Disclosure Rule, ESG, and several non-financial reporting regulations induce pressure to demonstrate transparency and accountability. The stakeholder pressure will drive opportunities to leverage ESG as a strategic tool for risk management, capital and investor opportunity, and brand reputation.

3. Macroeconomic Trends Impact Enterprise Risk Strategies: The effects of economic uncertainties, inflation, geopolitical tensions, great resignations, and an imminent recession influence boardroom decisions. They impact executives’ and leaders’ agendas for workforce hiring, employee engagement, compensation practices, and technology investments to manage financial resilience and adopt proactive enterprise risk management approaches.

Many enterprises and corporations will consider investing in risk management teams and technologies to conduct proactive risk assessments, identify compliance gaps, automate internal audits, and manage policies.

4. Scrutiny of Board and C-suite Decisions: Recently, expectations from directors and boardroom decisions have boomed proportionately due to the scale of developments in social media and communication channels. Consumer and shareholder activism has surfaced around CEO compensation against increasing interest rates, rising prices, and global supply chain disruptions.

Additionally, the demographic shifts and skill gaps in the age of continuous innovation are igniting scrutiny over organizational culture and managerial practices. Boards and leaders are continuously evaluated for integrity across sensitive aspects like diversity, board composition, compensation, etc.

5. Technology and AI Ethics Boards: Embracing advanced technologies such as AI and GenAI for strategic and transformative advantages means ensuring enough consideration for potential security risks and implications around transparency and ethics.

Boards and C-level leaders are integral in proving that their AI models are responsible, bias-free, and ethical. Boards also manage and enable the investments for AI deployment in addition to enterprise-wide GenAI applications. Therefore, they are accountable for data models and quality impacting AI decisions. Their AI objectives must be aligned with governance and long-term enterprise strategies.

6. Data Governance Priorities: Companies are actively regulated for how they collect, utilize, store, and protect data while preventing its misuse. Data governance and data protection teams are integral to the board and herald data protection and management strategies.

In today’s hyper-digitalized and AI-driven times, more and more consumers are concerned about how their data is used. It has become imperative for companies and their board to actively demonstrate data auditability, standardization, transparency, and integrity with relevant data governance plans.

At iTech GRC, we help customers leverage our GRC resources network to assess their governance, risk, and compliance (GRC) requirements. Utilizing the AI-powered features within the IBM OpenPages platform, our GRC professionals redefine enterprises’ governance strategies to build compliant organizations.

Contact our experts today!