Role of Regulatory Technology in Simplifying Compliance Processes

Did you know that despite rapid technological advancements, approximately 60% of GRC users still rely on manual spreadsheet-based compliance management? It’s a real hassle! For organizations seeking to eliminate such inefficient processes, Regulatory technology is helping companies navigate the often-confusing regulatory compliance model. It’s like having a GPS for your business, showing you the way, and helping you avoid regulatory fines and roadblocks with confidence. Technology has shaped how companies comply with regulations and given them more freedom and control over their operations.

According to Gartner, Inc., investment in governance, risk, and compliance (GRC) tools by legal and compliance departments is expected to increase by 50% by 2026. Assurance leaders are seeking out technology solutions to help them address increasing regulatory attention on executive risk oversight and monitoring. This quest for more efficient GRC processes is demonstrated by the advancements in regulatory technology (RegTech).

RegTech: Simplifying Compliance

RegTech is short for regulatory technology. The name refers to using technology to help companies adhere to regulations. RegTech solutions are designed to simplify regulatory compliance by automating tasks and providing a clearer view of operations. They use AI and ML to analyze real-time data, helping companies address issues before they escalate.

By adopting RegTech, companies can now handle compliance better than ever before. These technologies enable them to quickly identify and manage compliance risks, saving money by automating tasks and providing better operational insights.

The 2023 Thomson Reuters Risk & Compliance Survey Report indicates that AI adoption is anticipated to increase among risk and compliance departments to achieve their objectives. Half (48%) of surveyed professionals in these fields believed AI could enhance internal efficiency, while 35% saw it as a tool to stay informed about upcoming regulatory and legislative changes.

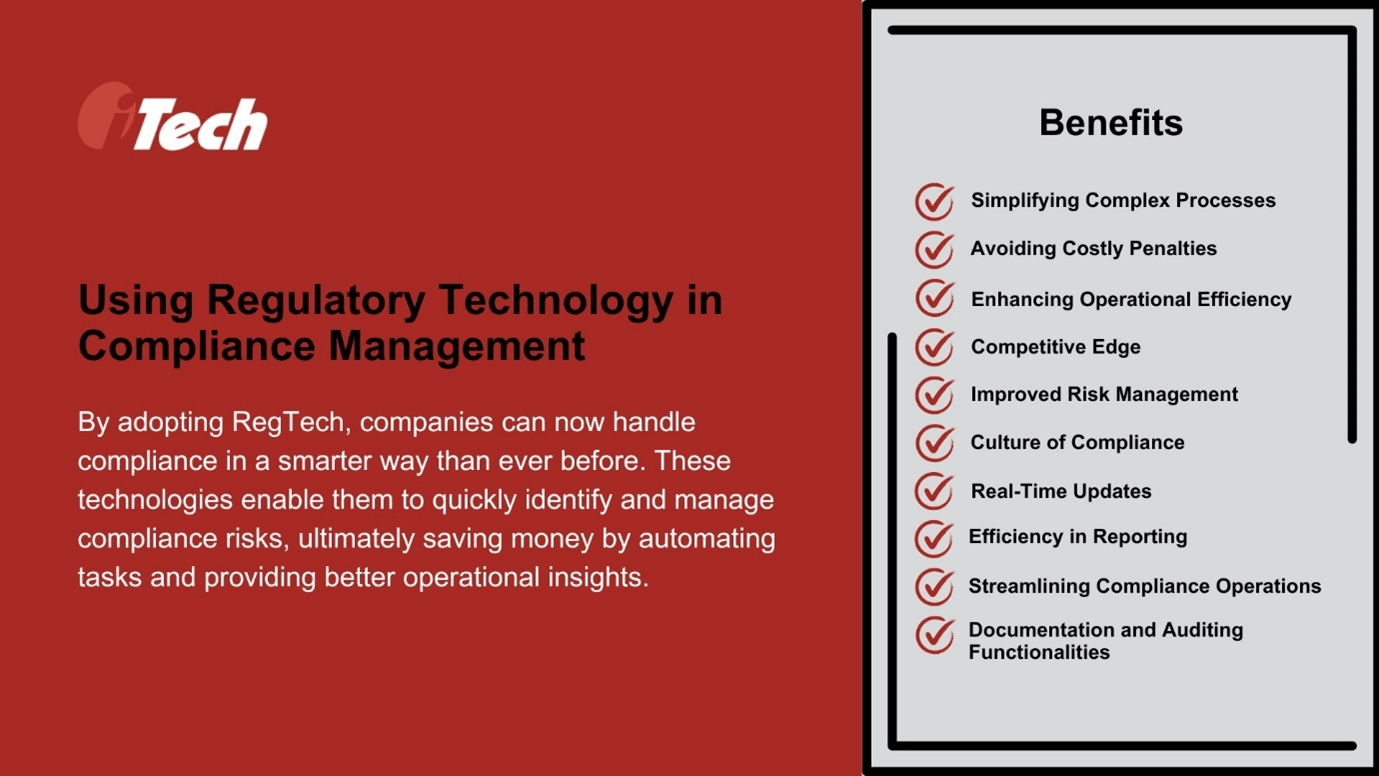

Benefits Of Using Regulatory Technology in Compliance Management

Utilizing regulatory technology in compliance management offers numerous benefits:

- Simplifying Complex Processes: Automation simplifies intricate compliance procedures, making them easier for businesses to manage and understand.

- Avoiding Costly Penalties: Automated compliance aspects help organizations avoid expensive penalties for noncompliance with regulations.

- Enhancing Operational Efficiency: Automated tools save time and reduce errors that would otherwise occur with manual compliance tasks, improving overall operational efficiency.

- Competitive Edge: Technology improves compliance processes, allowing businesses to adapt swiftly to regulatory changes and minimize compliance risks, providing a competitive edge.

- Improved Risk Management: Machine learning and AI can anticipate risks, enabling organizations to proactively address compliance issues and manage risks effectively.

- Culture of Compliance: An integrated compliance process supported by technology fosters a culture of compliance within the organization, ensuring that employees are aware of and adhere to relevant legal requirements.

- Real-Time Updates: Technology-driven solutions can adapt swiftly to regulatory changes, providing real-time updates and minimizing compliance risks.

- Documentation and Auditing Functionalities: Technological tools provide documentation and auditing functionalities that ensure transparency and oversight of compliance procedures.

- Efficiency in Reporting: Technology improves efficiency, precision, and trustworthiness in reporting, fostering communication with regulators and stakeholders.

- Streamlining Compliance Operations: Leveraging technology streamlines compliance operations, ensuring processes are carried out efficiently, accurately, and transparently, reducing errors and boosting adherence.

Integrating technology into compliance management processes is essential for businesses looking to stay competitive, ensure sustainability, and minimize compliance risks.

Challenges of Using Regulatory Technology for Compliance Management

Incorporating RegTech for compliance comes with its own set of challenges. While these technologies offer innovative solutions, their adoption for compliance also brings challenges. They can be expensive to implement and maintain, posing company resource challenges. Additionally, the need for more standardization among different RegTech solutions can make it challenging for companies to integrate them into their operations effectively.

Here are some common issues organizations may encounter when implementing compliance technology:

- Complexity: Compliance technology can be intricate and challenging to implement, especially for organizations with multiple existing systems. This complexity can lead to added costs, delays, and inefficiencies.

- Lack of Integration: Inadequate integration among different technological solutions can result in duplicated efforts and increased error risks, potentially leading to non-compliance and penalties.

- Changing Regulations: The advanced nature of regulatory requirements necessitates that technological solutions quickly adapt to these changes. This can be particularly difficult for smaller organizations with limited resources.

- Inadequate Training: Insufficient training during the implementation of regulatory compliance technology can result in errors, inefficiencies, and non-compliance, leading to penalties.

- Cost: Implementing regulatory compliance technology can be costly, especially for smaller organizations. Expenses related to technology solutions, training, and implementation can accumulate, making it challenging for some organizations to justify the cost.

- Data Security: Regulatory compliance technology often involves handling sensitive data, making it a potential cyber-attack target. Organizations must ensure their technology solutions have robust data security measures to protect against data breaches. According to Statista, 34% of risk management experts identified cyber incidents, such as cybercrime and data breaches, as the top risk to businesses globally in 2023.

- Vendor Selection: Selecting the right vendor for regulatory compliance technology can be challenging. Organizations should ensure that the vendor has a successful track record, can provide examples of technology standing up to regulatory scrutiny, offers adequate support and training, and can adapt to changing regulatory requirements.

- Choosing the Right Implementer: Opting for the technology developer’s implementation team may only sometimes be the best choice. Instead, organizations should consider the following factors when selecting an implementer for regulatory compliance technology:

- Expertise and Experience: Look for an implementer with experience implementing similar technology solutions within the same or similar industry.

- Knowledge of the Regulatory Reforms: The implementer should have a thorough understanding of the regulatory environment applicable to the organization, including relevant regulations, industry standards, and any updates that may impact compliance requirements.

How to integrate Regulatory Technology?

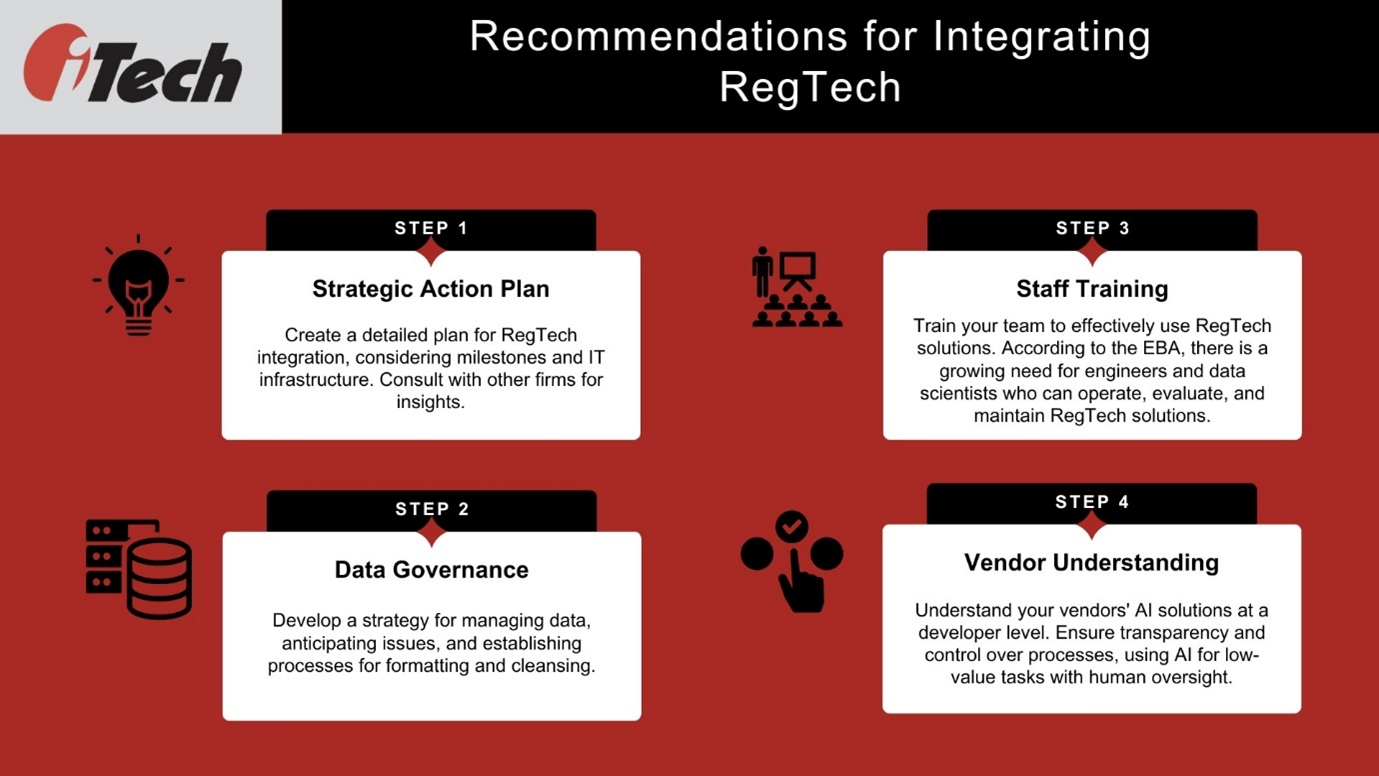

When integrating RegTech into their operations, organizations can follow these practical recommendations:

- Strategic Action Plan: Start by creating a detailed action plan. Understand the milestones you want to achieve with RegTech and analyze your IT infrastructure to identify any technical challenges. It’s helpful to consult with colleagues from other firms who have already integrated RegTech to learn from their experiences. This research will help you develop a realistic action plan and budget.

- Data Governance: Develop a data governance strategy to plan how data will be managed. Anticipate potential data issues and establish processes for data formatting and cleansing. Create a framework for migrating data between different environments and regulatory fields.

- Staff Training: Invest in training for your staff. Even the most advanced RegTech solutions will only succeed if your team is trained to use them effectively. According to the EBA, there is a growing need for engineers and data scientists who can operate, evaluate, and maintain RegTech solutions. Constantly invest in training to keep your team up to date with the latest technologies.

- Vendor Understanding: Understand how the AI from your vendors works at a developer level. Ensure your vendors are transparent about their solutions and understand your unique regulatory challenges. Some experts suggest using AI for low-value tasks and ensuring human operators control the processes.

In conclusion, the challenge for companies today is to find RegTech solutions that provide long-term value. Investing in RegTech solutions is crucial for staying competitive. The industry needs to understand the potential changes these solutions can bring so that they can develop together rather than separately.

How iTech GRC helps you improve your security and compliance?

No matter the industry, risk and compliance practices are vital for business operations. Regularly assessing and monitoring your compliance strategy can save money and enhance security.

iTech GRC provides Enterprise Risk Management Solutions for Regulatory Compliance, serving as a trusted IBM RegTech partner for IBM OpenPages services. The company offers seamless end-to-end regulatory compliance management using the IBM OpenPages Regulatory Compliance Management (RCM) solution. This solution enables businesses to develop a centralized repository of obligations, classify complex regulations, and process large volumes of data efficiently. It also automates the identification of regulatory changes, reduces unmanageable volumes of regulatory alerts, and enables mapping regulatory requirements to internal risk data. iTechGRC emphasizes the user-friendly interface and highlights IBM OpenPages as a winner of the Risk Market Technology Awards.

Schedule a demo to see how iTech GRC can automate and streamline compliance processes, saving your time and ensuring compliance.