How Regulatory Compliance Solutions Can Be Your Winning Strategy in Business?

“In business, as in games, those players who understand the rules have the highest chance of winning.”

Running successful business these days requires more than just savvy decision-making and strategic insight; it demands a deep understanding and strict adherence to regulatory compliance. Much like mastering a challenging board game, knowing and following the rules in business isn’t just about avoiding penalties; it’s about turning compliance into a strategic advantage that can distinguish a business from its competitors.

Regulatory compliance in business can often seem like an overwhelming task. Rules can be intricate, and the stakes are high. Mistakes can lead to severe penalties, damaged reputations, or even to the closure of the business. According to a study, organizations typically lose an average of $4 million in revenue from a single non-compliance incident.

However, compliance is less of a burden when organizations approach it correctly. The right compliance strategy gives business a competitive advantage. It provides a blueprint for success. On average, businesses can save $1.03 million through effective regulatory monitoring. Additionally, doing so ensures fair play, maintains public trust, and establishes a level playing field, much like the rulebook in a game that provides fair competition among players.

Compliance isn’t just about following the law; it’s a competitive business advantage. Those who master the approach of handling regulations often come out ahead. Let’s go through how businesses can transform compliance challenges into competitive advantages, positioning themselves for success within their industries.

Learning the Rules – Understanding Compliance Regulations

“In the game of business, knowing the rules isn’t just about staying in the game; it’s about strategizing to win.”

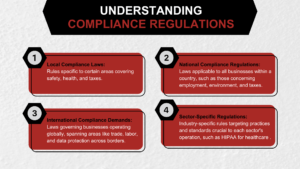

Each regulatory compliance decision must be informed and deliberate, influencing the overall strategy for success the same as it is when tackling a complex board game. To master the compliance game, businesses must start by reviewing the extensive rulebook that governs their operations. This includes understanding local, national, and international regulations that can impact various aspects of their operations.

- Local Compliance Laws: Local compliance laws are rules that businesses in a particular area must follow. They cover things like building safety, health rules, and taxes. Businesses can get help from legal experts to handle them well and train their staff regularly. Following these rules keeps businesses running smoothly and out of trouble, which is essential for long-term success.

- National Compliance Regulations: National compliance regulations encompass laws that apply to all businesses operating within a country, covering various areas such as employment, environment, and taxes. They are crucial for ensuring fair practices and accountability on a broader scale. Examples include HIPAA laws in the United Statesfor healthcare privacy, GDPR for data protection, and the Sarbanes-Oxley Act for corporate governance. To master national compliance, businesses should stay informed about legislative changes through subscriptions and industry seminars. Utilizing compliance software to track legal updates is also advisable for adequate adherence to regulations.

- International Compliance Demands: International compliance demands refer to the necessity for businesses operating globally to adhere to laws governing multinational operations. These regulations encompass various aspects, such as trade, labor, and data protection standards across borders. Examples include the Basel Accords in banking, OECD guidelines for multinational enterprises, and the EU’s GDPR. To master international compliance, businesses can establish a dedicated team or outsource to firms specialized in international law. Regularly reviewing compliance strategies to align with geopolitical changes is essential for mitigating non-compliance risks and ensuring smooth global operations.

- Sector-Specific Regulations: Sector-specific regulations target particular industries, emphasizing practices and standards crucial to each sector’s operation. For instance, HIPAA and HITECH in the United States govern patient information handling in healthcare, while the Dodd-Frank Act in finance impacts how institutions manage risk. To master these regulations, joining industry associations offers valuable resources, while employing or consulting sector-specific compliance experts ensures a thorough understanding and implementation of all regulations.

Strategic Moves – Implementing Compliance Tools

“Equipping yourself with the right tools can turn a beginner into a master strategist in the complex game of compliance.”

In any strategic game, the tools and resources available to a player can significantly influence their chances of success. The same applies is true in business, utilizing the appropriate compliance tools is crucial for efficiently and effectively navigating the maze of regulations. Here’s a look at some of the critical compliance tools that act as strategic assets for businesses:

- Compliance Management Software: Compliance management softwareis the central hub for overseeing all compliance activities within an organization, like a game board where every piece converges. This integrated platform facilitates the management, tracking, and reporting of compliance efforts across all levels of the organization. Key features of this software include automated workflows for document management, comprehensive audit trails, compliance tracking mechanisms, and real-time reporting capabilities. The software streamlines operations by automating repetitive tasks, reducing manual workload, and enhancing accuracy in compliance reporting. Consequently, it renders the regulatory process more transparent and manageable, ensuring efficient organizational compliance management.

- Automated Monitoring Systems: Automated monitoring systems act as vigilant scouts or guards within a game, continuously monitoring the environment for potential threats or breaches. These systems feature critical functionalities like monitoring compliance parameters and alerting managers to deviations from established standards. The real-time alerts enable swift responses to potential compliance issues, significantly reducing the risk of costly violations and penalties.

- Training Modules: Training modulesserve as the rulebooks and strategy guides for players, helping employees understand and navigate the complex regulations and their specific compliance responsibilities. These modules typically offer interactive content, quizzes, and real-life scenarios to ensure effective learning and retention. Well-trained employees are better equipped to recognize and mitigate compliance risks, reinforcing the organization’s compliance framework.

- Audit Software: Audit softwarefunctions as the review system within the game, enabling businesses to reassess their strategies and gauge their compliance status. Key features include the creation of audit trails, simplified data collection, and detailed reporting capabilities. This software enhances the transparency of the compliance process, facilitating the identification of improvement areas and ensuring accountability throughout the organization.

[Check out a detailed blog on the New Global Internal Audit Standards In 2024 for more insights.]

- Risk Assessment Tools: Risk assessment toolsresemble strategic planning sessions in a game, allowing players to assess potential threats and prepare counter-strategies. These tools assist in identifying, categorizing, and prioritizing risks based on their likelihood and potential impact. By understanding the most significant risks, businesses can allocate resources effectively and focus compliance efforts where they are most needed, optimizing their risk prevention strategies.

Keeping Score – Monitoring and Auditing

“Only by keeping accurate scores can a player truly understand his position and confidently plan the next move.”

In the strategic game of compliance, continuous monitoring and auditing represent the process of keeping score. This ongoing vigilance ensures that the business adheres to the rules and strategically adapts to new regulations and internal audit changes. Effective monitoring and auditing are essential for maintaining transparency, identifying risk areas, and ensuring that compliance measures are up-to-date and effective.

Imagine compliance monitoring systems as your game board observers, always keeping you updated on what’s happening in real time. These systems continuously track data, promptly notify you of any issues, and seamlessly integrate with your existing technology setup. So, it’s like having a team of patrols that ensure you’re always on top of compliance matters without missing a beat.

Whereas audits act like regular check-ins on your game strategy, allowing you to review your tactics, adjust as needed, and ensure you play by the rules. These audits can be conducted internally by your own team or externally by independent experts to ensure your compliance efforts are effective and your reporting is accurate. It’s like getting feedback on your gameplay to ensure you’re on the right track and staying true to the game’s rules.

By leveraging technology, such as artificial intelligence (AI) and data analytics, you can simplify the monitoring and auditing processes, making them more accurate and efficient.

Winning Tactics – Building a Culture of Compliance

“In any game, the players’ mindset can often be as critical as their skills or the strategies they employ.”

Building a culture of compliance within an organization is akin to developing a winning mindset among all players in a strategic game. It involves emphasizing the significance of compliance throughout the organization and integrating it into everyday decision-making processes.

[To discover how technology can assist you in achieving this goal, check out a comprehensive blog on the Role of Regulatory Technology in Simplifying Compliance Processes.]

Leaders play a crucial role in this by actively demonstrating their commitment to compliance and encouraging others to do the same. Engaging employees through ongoing education and communication ensures that everyone knows their responsibilities and the importance of compliance in achieving organizational goals.

Recognizing and rewarding individuals who excel in compliance efforts reinforces its value and encourages others to follow suit. Additionally, creating channels for feedback allows employees to voice concerns and suggestions, fostering a collaborative approach to compliance management. By cultivating a compliance culture, organizations mitigate risks, enhance their reputation, and promote a cohesive and responsible work environment.

Celebrating Your Wins

“Just as a well-played game brings satisfaction and victory, mastering the game of compliance brings security and success to your business.”

Wrapping up our discussion on regulatory compliance, I want to highlight the importance of having the right tools and partners by your side.

That’s where iTech GRC comes in. As an IBM OpenPages partner, iTech GRC offers comprehensive solutions tailored to your business’s compliance needs. From regulatory tracking to risk management, their expertise, and technology can streamline your compliance efforts, giving you peace of mind and a competitive edge in your industry. Ready to take your compliance game to the next level? Explore iTech GRC’s offerings today and stay ahead of the curve!