How Important is an ESG Score for BFSI Firms?

The rapid globalization and technological evolution over the last decade have led to a drastic increase in trade flows and per capita income among developed and developing nations. The macro impacts of these developments are evident in our environment, with the use of natural resources and climate change ultimately driving the urgency for collective sustainability by corporations, governments, and legal entities. Concurrently, environmental, social, and governance (ESG) compliance has become a global vocabulary.

With an exclusive focus on managing and mitigating sustainability risks, many countries have introduced individual ESG regulations. These regulations impose strict compliance standards for companies in the banking, financial services, and insurance sectors otherwise known as BFSI. These strict standards are meant to encourage organizations to keep a close eye on their ESG footprint and the investment opportunities fulfilled by them as ‘lenders.’

In practice, ESG is still a nascent concept that is evolving in terms of standardization in risk reporting, data disclosure, and accuracy in measuring intent and opportunities. However, the demand for ESG-conscious investment decisions makes ESG compliance a major competitive benefit for BFSI companies. According to Harvard Law School’s ESG Global Study in 2022, North America boasts 79% of ESG users and almost 63% of global investors favor investing in funds that integrate ESG considerations. Bank of America reported nearly $200 billion in investments in ESG bond funds between 2019 and 2022. Hartzmark and Sussman (2019) show that five global funds received $24 billion in investments based on their sustainability ratings.

Additionally, observations during the COVID-19 pandemic also indicate that business models that account for ESG factors are less likely to face the negative impacts of sudden technological and regulatory disruptions. All of which are extremely important for elevating their competitive edge and long-term growth trajectory.

Another strong reason to keep track of ESG data for financial services companies comes from the rise in environmentally conscious consumers. Today consumers don’t just want great products and services they also want them to be environment friendly. According to a Deloitte study, nearly 94% of Gen Z representatives believe that companies should include ESG as part of their core business operations and 92% prefer a brand with strong ESG considerations.

Role of ESG Rating Agencies

The data insights on ESG performance offer valuable insights into the factors that affect corporate financial ratios. However, there is no consensus on the methods of ESG data analysis and ways of calculating ESG risk scores. ESG rating agencies therefore exist to assess and rank investors, asset managers, financial services firms, banking, and insurance companies on their ESG performance. In this blog, our aim is to help our readers demystify an ESG rating and understand why they matter for BFSI companies.

There are over 600 ESG rating agencies each with their own unique rating standards. These agencies are scrutinized based on their ESG rating practices, assessment methodologies, as well as the depth and accuracy of the ESG data insights. Their ESG ratings are referenced by institutional investors, regulators, asset management companies, and other relevant stakeholders. ESG scores are used to review ESG performance, increase investments, gain access to low-cost capital, and make strategic business decisions.

At a high level, there are three types of ESG rating agencies:

- Basic Data Providers: ESG providers that disclose a firm’s publicly available information or unprocessed data from their websites.

- Comprehensive Data Providers: These agencies provide a combination of publicly available information and exclusive data gathered from audit analysis and questionnaires on ESG-related factors.

- Specialized Data Providers: Provide contextual information on one or a few specific ESG aspects. These providers are often sought out by investors who are looking at assessing a specific component of ESG and how it can be improved

What Does an ESG Rating Mean?

ESG ratings are similar to credit ratings for banking and financial companies and are based on well-defined ratios. ESG ratings are various scoring patterns for non-financial data based on a variety of indicators and assessment factors that are unique to each agency. Low ESG ratings mean poor ESG performance.

Typically, ESG ratings are reported on a letter or a number scoring pattern. For example, some of the major ESG rating agencies use a 7-point scale from AAA to CCC. Others use a 12-point scale from A+ to D-. The percentile-based scoring between 1 to 100 is the most popular method used for measuring an organization’s ESG score.

Some of the rating systems are industry-relative. There are also ESG rating providers whose ESG scores can be used for comparing businesses with their peers across industries.

In a nutshell, ESG ratings determine ESG quality and its impact on stakeholders including customers, suppliers, employees, society, and the environment. Companies can boost their ESG ratings by curbing any related activity or business practice considered harmful to any of the stakeholders. The individual ESG components and factors directly influencing them are assessed and aggregated to arrive at an overall score.

Another definition of ESG ratings or scores suggests that the ESG framework reveals a set of social and environmental risk factors that companies can regulate and enact through strategic planning, changes in operational processes, and targeted investments. This interpretation measures the overall impact of social and environmental factors on a firm’s financial performance. Briefly, the overarching theme of ESG ratings is investment risk reduction.

There are also specialized agencies that provide corporate governance data for ESG assessments.

An Overview of Leading ESG Rating Agencies and their ESG Score Methodologies

- Bloomberg ESG Rating: Bloomberg’s ESG rating scale ranges from 0-100. It provides annual ESG performance evaluations of more than 10,000 listed public companies across the globe with market capital of over $ 2 billion by collating data from publicly available sustainability reports, annual reports, and corporate social responsibility (CSR) data of companies. The data is measured and compared against 120 ESG indicators such as carbon emission rates, climate change, waste disposal methods, supply chain, human rights, discrimination, shareholder rights, and more. Businesses that fail to disclose ESG-related data can invite penalties.

- S&P Global Ratings: The S&P Global Ratings ESG Evaluation provides assessments of corporations, public finance, banking, and insurance companies. This ESG evaluation is based on quantitative, performance-driven metrics across 61 GICS ®-aligned sub-industries. The scoring system of 0-100 is awarded based on the quality, relevance, and performance of ESG data points gathered from the entity’s disclosure and interaction with the management and board members. This evaluation tool is for the investors to examine a company’s awareness of the relevance and impact, quantification of ESG risk exposure, and potential ways to implement strategies that help manage sustainability risks and capitalize on opportunities.

- CDP Scores: Previously known as the Carbon Disclosure Project, the CDP is an ESG scoring system built on incentivizing business entities that track and manage environmental impacts through questionnaires on climate change, forests, and water security. The CDP’s ESG ratings range between D- to A based on the companies’ level of disclosure on the disclosure, awareness, management, and leadership. This scoring practice is aligned with the Taskforce for Climate-Related Financial Disclosures (TCFD) and other industry-approved environmental standards.

- ISS ESG Ratings & Rankings: The Institutional Shareholder Services or ISS’ ESG scientific rating system has a sector-specific focus on the materiality of non-financial data. The ESG scoring methodology is constantly updated to include all ESG-related factors. The ISS Quality Score rating system is based on a scale of 1 to 10th decile with the 1st decile indicating high-quality governance/lower risk and the 10th decile reflecting high governance risk. This rating system is based on an analysis of over 200 factors broadly grouped into four categories and weighted on the governance standards in each region, the ISS voting policy, and the influence of governance practices. With its strategic partnership with the CDP, ISS-Ethix launched the climate impact rating called the Climetrics to enable investors to make climate-friendly investments.

- FTSE Russell’s ESG Ratings: FTSE Russell’s ESG scores and data model offer a comprehensive overview of a firm’s exposure to and management of ESG issues. The ESG rating is based on three pillars and themes that are built on 300 unique indicator assessments relevant to each company’s ESG situation. The FTSE ESG scores are available online and include about 7,200 securities across 47 developing and emerging markets, other constituents of the FTSE All-World Index, FTSE All-Share Index, and Russell 1000® Index.

- MSCI ESG Ratings: Morgan Stanley Capital International or MSCI ESG ratings are based on assessments of thousands of data points across 35 core ESG issues that are further divided into ESG pillars and ten other themes. The data is gathered from government databases, voluntary disclosure by companies, and data sourced from academic, government, and NGO databases. This method uses a rule-based system to categorize companies as industry leaders and laggards as per the ESG risk exposure. The leaders are rewarded with AAA, AA, average with A, BBB, and BB to laggard with B and CCC.

- Thomson Reuters ESG Research Data: Thomson Reuters ESG ranking methodology provides a detailed ESG factors analysis for almost 6,000 public companies and uses a percentile ranking to measure ESG scores. The scoring methods are based on 400 ESG metrics weighted on many factors with categories grouped into issues. The ESG scores can be accessed over the Thomson Reuters Eikon platform by investors or by companies.

- Sustainalytics ESG Risk Score: Morningstar Sustainalytics is one of the market-leading providers of ESG research and ESG data for over 16,0000 companies. It is an analyst-based ESG risk rating that covers a range of businesses including public and private companies, fixed-income issuers, and listed Chinese firms. The Sustainalytics ESG risk ratings evaluate a business’s exposure to industry-specific ESG risks and measure how well it is managed. Their rating scale is a 0-100 scoring system for analysis of core indicators that are split into three ESG themes preparedness, disclosure, and performance. The company’s ESG rating results are available from third-party providers like Bloomberg, FactSet, and IHS Markit.

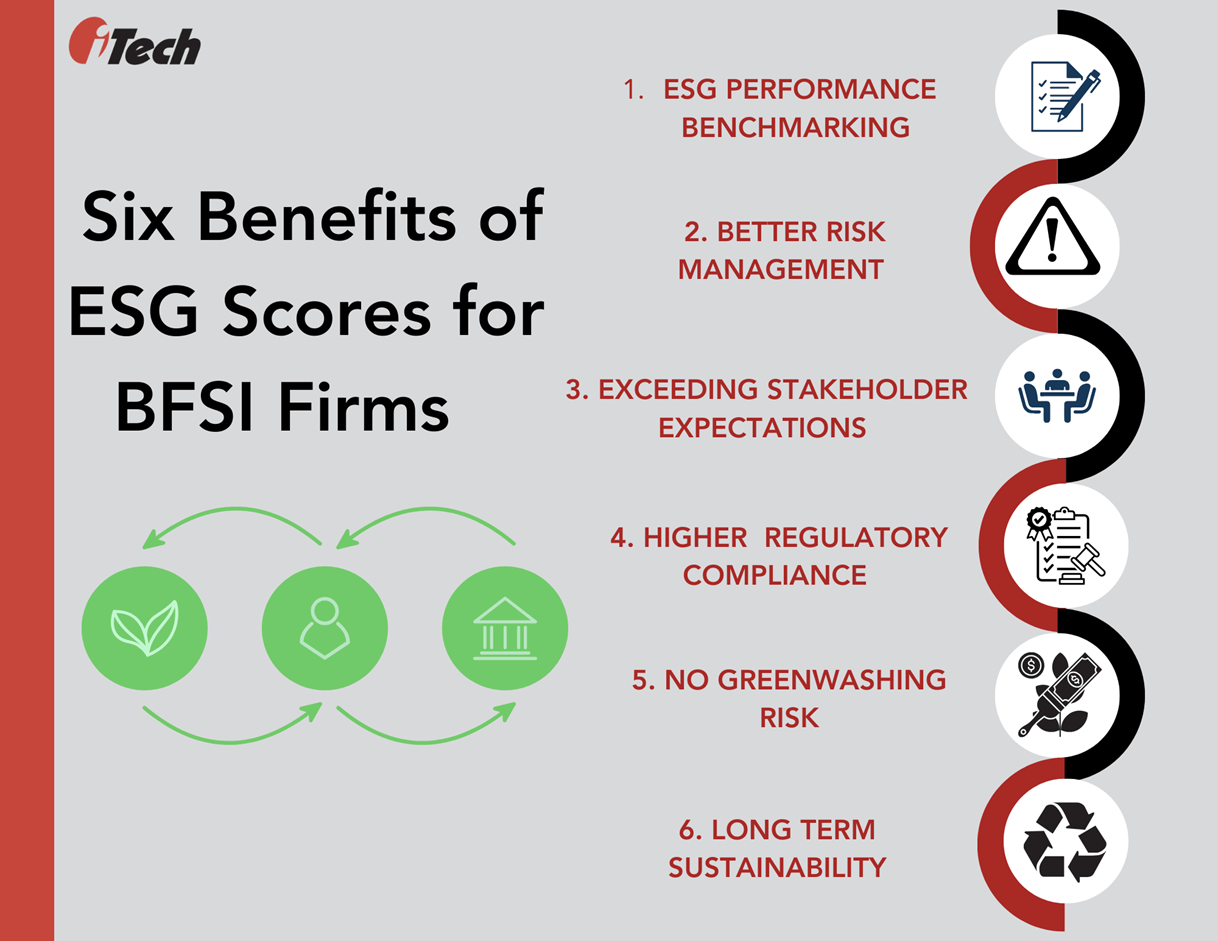

Six Benefits of ESG Scores for Companies

- ESG Performance Benchmarking: An ESG rating by recognized agencies serves not only as a screening and due diligence tool for investors but also for businesses to keep track of their ESG performance and risks. The ESG performance benchmarking helps set clear objectives on ESG integration with corporate and business practices, and company values and beliefs profit making, human rights, environmental sustainability, and corporate governance.

- Better Risk Management: ESG ratings and scores help identify businesses and the key areas that need immediate attention and improvement on ESG aspects for better risk management. By proactively tracking relevant ESG metrics and reliable indicators, businesses can act to mitigate their impact on the environment and society.

- Exceeding Stakeholder Expectations: Financial or bank ESG scores build transparency which is critical to building trust with customers, employees, investors, and stakeholders. By bringing into light the non-financial ways a business is impacting the environment and economy with external reporting, they can promote good governance practices and standards for their industry peers.

- Higher Regulatory Compliance: Private equity companies and investment portfolio managers will have to justify their investment decisions and how they align with ESG aspects. Further, many policies list regulations regarding establishing taxonomy, disclosure, reporting, and analysis methodology. Any failure to comply with the regulations can not only impact their access to capital but also invite risks of ESG exclusion, legal fines and penalties, and reputational damage.

- No Greenwashing Risk: Investing funds into businesses or corporations that employ greenwashing, a marketing gimmick of luring environmentally conscious customers with false and misleading information can be avoided with ESG rating by Bonafide rating agencies and third-party ESG score providers. The availability of online tools that measure the impact of mutual funds, public funds (401Ks), and other investment portfolios helps both investors and customers keep track of sustainability scores and learn where their money is invested.

- Long-term Sustainability: ESG scores correlate to a business’s long-term value creation and sustainability objectives. Reliable ratings reflect ESG implications and reveal a business’ ESG data management, reporting practices, and incumbents to sustainability to ensure they adhere to the UN’s 17 sustainability development goals (SDGS).

Our Takeaway:

ESG ratings are the guiding compass to the road toward a sustainable and equitable global economy. Technology is a key enabler in measuring, reporting, and analyzing ESG data and metrics. To avert long-term risks and incorporate ESG considerations in investment decisions, BFSI companies require tools that set clear KPIs and guidelines on integrating ESG data with financial information.

Integrated ESG risk management platforms built for easy compliance with sustainability standards also evaluate threats and risks associated with operations. To govern ESG programs, enterprises need timely visualization and analysis of ESG data, and other innovative capabilities that cover non-financial use cases to stay on top of the ESG goals.

Our team of experts works with market-leading investment portfolio management companies and other renowned players in the financial sector by catering to their unique technological needs for seamless ESG risk management. We invite you to join the iTech team to get the conversations going about the management of your ESG risks!