How IBM OpenPages User Interface Improves Risk Management

Enterprise risk management is a highly dynamic and complex discipline, with companies investing a significant amount of time, money, and effort into neutralizing threats and mitigating risks. To achieve their risk management objectives, an increasing number of businesses are leveraging tools such as IBM OpenPages.

This artificial intelligence-driven governance, risk, and compliance software platform — better known as GRC software — has become an extremely popular choice amongst companies that are seeking to deploy technology that streamlines and simplifies their risk management efforts. But how does the IBM OpenPages user interface serve to enhance and improve risk management?

How Does IBM OpenPages Software Work?

As a GRC platform, the IBM OpenPages user interface includes a number of features that improve a company’s risk management positioning. This makes the software platform a good option for companies that are looking for high-tech tools that will support their risk mitigation strategy and related activities.

The highly scalable and AI-driven IBM OpenPages software system runs on IBM’s cloud platform, Cloud Pak for Data. Its features and functionalities are all designed with risk management in mind, including governance, regulatory compliance, and risk mitigation.

A fair amount of buzz continually surrounds IBM OpenPages thanks to its use of IBM Watson technology. IBM Watson has repeatedly made headlines since the technology emerged from the company’s DeepQA project back in 2010. IBM Watson uses artificial intelligence technology to answer questions “posed in natural language.” This makes for a more engaging and responsive platform that companies use to manage risks and oversee risk mitigation efforts.

The IBM OpenPages user interface spans several different modules, with each one designed to address risk factors and vulnerabilities that exist in a specific region of the company’s risk management landscape. The OpenPages risk management modules include the following.

- Operational Risk Assessment and Management

- Financial and Model Risk Governance (MRG)

- Company Policy Management

- Financial Controls Management

- IT Governance

- Internal Audits and Reporting

- Legal / Regulatory Compliance Management

The development of these modules represents one aspect of the OpenPages user interface that promotes more effective risk management. By segmenting a company’s risk management efforts in this way, you can achieve a more refined focus that serves to streamline risk mitigation activities.

IBM OpenPages Data Visualization Tools for Better Risk Management and Mitigation

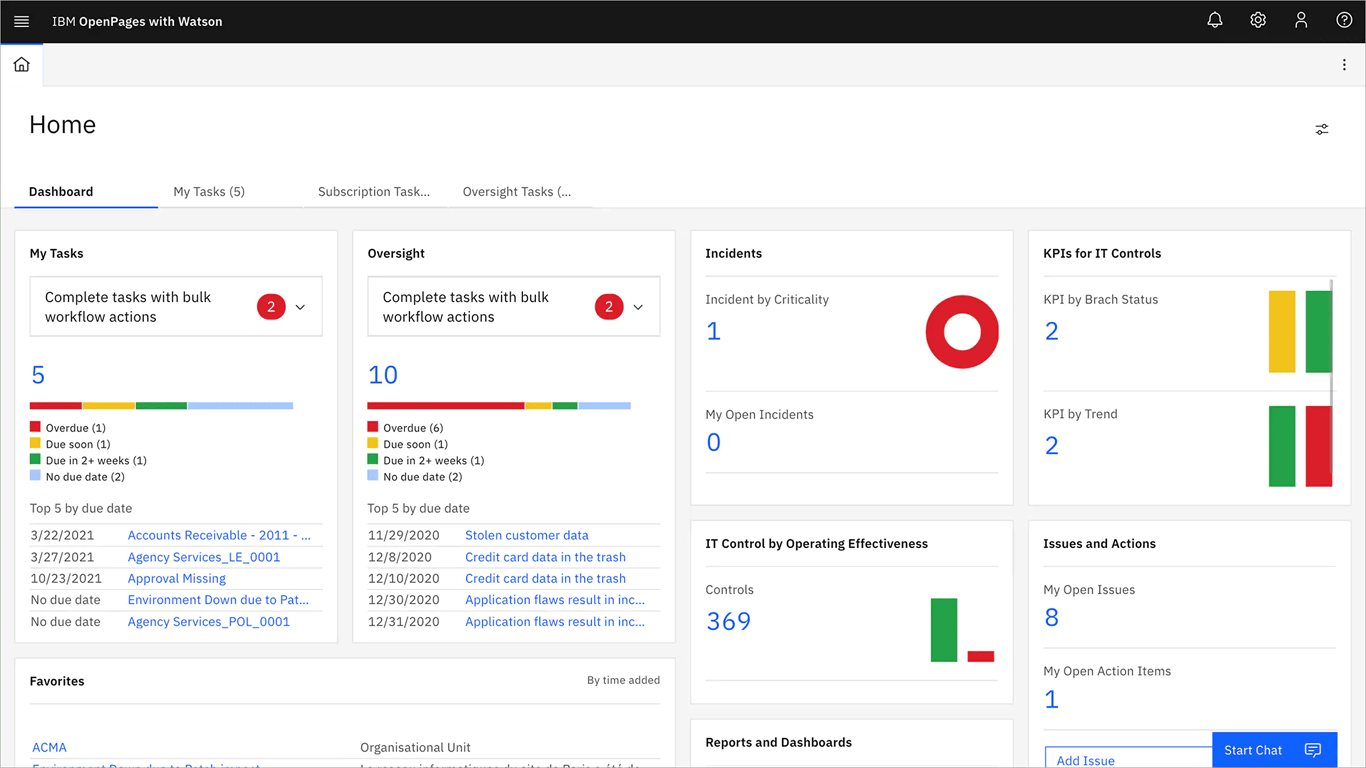

Data visualization tools are regarded as some of the most sought-after features that are included within the IBM OpenPages platform. The data visualization toolset receives data from integrated systems and platforms. This data is then processed and graphical data renderings are generated to provide charts, graphs, and other visual representations of the information and the relationships between multiple data points.

These visual data renderings make data far more “digestible” and easier to understand. A better understanding of data makes it more useful, whether you’re developing a strategy, compiling a report, or performing an audit as part of your regulatory compliance-related activities. In general, data visualization tools allow a business to make use of its data far more effectively. Data visualizations are great for promoting an accurate understanding of the data and its implications — far more effective than if one were to present data in a more simplistic, raw numerical format.

IBM OpenPages Tools for Improved Financial Controls Management

Financial risk is a very real risk management consideration for virtually every business, regardless of industry or business type. Fortunately, the IBM OpenPages user interface includes tools that can be used to forward a company’s financial controls management efforts.

Financial controls take many forms, as these policies, protocols, and processes are designed to promote better accuracy and efficiency, while simultaneously preventing losses that may arise from errors, fraud, and oversights. Examples of financial controls include the following:

- Multiple countings for cash withdrawals and deposits;

- Account reconciliations;

- Using third-party risk management tools for vetting vendors, contractors, and other third parties; and

- Rotating staff responsibilities amongst employees.

These and other financial controls serve as checks and balances that empower a business in its efforts to minimize risk and reduce vulnerabilities. OpenPages includes tools that facilitate the implementation of new financial controls and allow for the monitoring of existing measures. Monitoring is critical to success in the realm of risk management because you must effectively detect problem areas and pinpoint risk factors that could ultimately result in losses.

OpenPages Promotes IT Governance Practices and Improved Security

The IBM OpenPages user interface includes tools for improved IT governance, which is critical if you’re going to maintain a high level of security while simultaneously minimizing cybercrime risks. Governance is a process that includes the active evaluation of the company’s IT-related policies, procedures, and security technologies, among other things.

Cybersecurity is an ever-evolving field, with cybercriminals continually identifying new vulnerabilities and developing new tactics and strategies to exploit those vulnerabilities. Today’s businesses are tasked with hitting a moving target when it comes to cybercrime and IT risk management. Yet an increasing number of regulatory groups are calling for more robust security measures to protect data, IT systems, and technology infrastructure. To be considered compliant, companies are tasked with implementing security measures that must meet a fairly high bar.

IT governance is highly complex, to say the least. OpenPages features tools that are designed to guide the process of becoming compliant with the deployment of appropriate IT security features. Users can also configure alerts and notifications that are sent out if a security breach or threat is detected. This makes for more effective risk management and improved IT governance with better protections for the organization’s technology and users alike.

IBM’s OpenPages and Operational Risk Management Tools

Much of a company’s risk management considerations surround its operations, including policies, procedures, and processes. Operational risk management can get very complicated since it often requires re-training employees, modifying long-established policies, or overhauling well-ingrained processes. There’s also the matter of human error. Human error can never be fully eradicated, but it can be minimized with the right operational risk mitigation strategy.

Using OpenPages as Part of a Multi-Pronged Risk Management Strategy

The OpenPages platform has tools and features that are designed specifically for operational risk management. By using these tools to streamline processes, minimize errors or inaccuracies, and update policies to reflect today’s best practices, you can mitigate operational risk very effectively. Notably, though, there are some operations with an inherent element of risk, with vulnerabilities, threats, and risk factors that can never be fully mitigated. In these cases, the focus is on minimizing threats and maintaining an acceptably low level of risk.

IBM’s OpenPages platform offers many tools, functionalities, and features that improve risk management. When you combine this platform’s tools with a well-developed risk management strategy and other innovative technologies, you can expect to see great benefits in your processes, protocols, cybersecurity, data management, and overall productivity levels.

iTech specializes in enterprise risk management technology, taking a collaborative approach to the development of new, innovative technologies that are designed to solve problems and eliminate challenges that stand in the way of achieving effective risk mitigation. We work to understand the client’s needs and pain points. With this insight in mind, we develop a digital transformation strategy with the technology your company needs to streamline your company’s risk management efforts. We invite you to contact the iTech team today to begin a dialogue on your company’s risk management strategy and your goals for the future.