How Compliance Software Companies Benefit Financial Institutions

Risk has a constant presence in the financial sector, shaped by the world’s volatile, uncertain, complex, and ambiguous (VUCA) nature. Financial institutions lacking robust business continuity or disaster recovery plans and or those unable to adapt quickly are vulnerable to the impacts of unmanaged risks. These risks can disrupt operations and damage the financial institution’s reputation.

Operational risks and challenges related to non-compliance, contract breaches, and control failures are significant concerns. Proactive management is essential, yet many institutions still take a reactive approach to compliance and legal risk.

The days of minimal legislative changes and minor penalties for non-compliance are over. Today, laws are frequently updated, with severe penalties for violations or control failures. This emphasizes the need for an integrated approach to Compliance Management software. Since the 2008 Global Financial Crisis, financial compliance has received increased attention from regulators and stakeholders. Adequate compliance during that period could have safeguarded people’s retirement funds, homes, and pensions and mitigated the recession’s severity. Furthermore, financial compliance is critical for maintaining public trust in capital markets and the banking system.

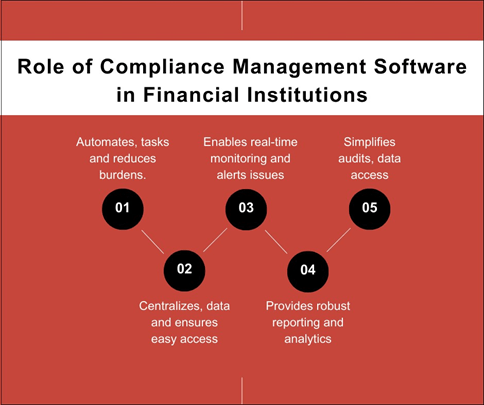

Role of Compliance Management Software in Financial Institutions

Compliance software companies offer robust compliance management software that is vital in helping financial institutions effectively manage compliance requirements. Here’s how:

- Streamlined Processes: Compliance software automates various compliance-related tasks, such as monitoring regulatory changes, updating policies, and managing documentation. This streamlines processes and reduces administrative burdens.

- Centralized Data: It centralizes all compliance-related data, including regulations, policies, and audit reports, in one secure location. This ensures easy access to information and keeps stakeholders updated with the latest compliance data.

- Enhanced Monitoring: Compliance software enables real-time monitoring of compliance activities and alerts stakeholders to potential issues. This proactive approach helps institutions identify and address compliance issues promptly.

- Reporting and Analytics: The software provides robust reporting and analytics capabilities, allowing institutions to track and analyze compliance performance. This helps identify trends and areas for improvement in compliance programs.

- Efficient Audits: Compliance software simplifies the audit process by providing auditors access to relevant compliance data and documentation. This streamlines audits and ensures they are conducted efficiently.

Benefits of Using Financial Compliance Software

Financial compliance software companies offer numerous benefits to financial institutions:

- Legal Protection: Ensures adherence to laws and regulations, protecting institutions from legal issues and fines.

- Reputation Management: Promotes transparency and ethical practices, enhancing the institution’s reputation.

- Risk Mitigation: Helps identify and manage financial risks, reducing the likelihood of fraud and other crimes.

- Access to Funding: Compliant institutions are more likely to secure funding due to their sound financial practices.

- Financial Stability: Ensures accurate financial reporting, proper tax payments, and adherence to accounting standards.

- Employee Morale: Instills employee trust and confidence, boosting morale and productivity.

- Competitive Advantage: Sets institutions apart from competitors, attracting clients and investors who value ethical practices.

By working with compliance software companies and leveraging their financial compliance software solutions, institutions can streamline compliance processes, mitigate risks, and uphold trust and integrity in the financial system.

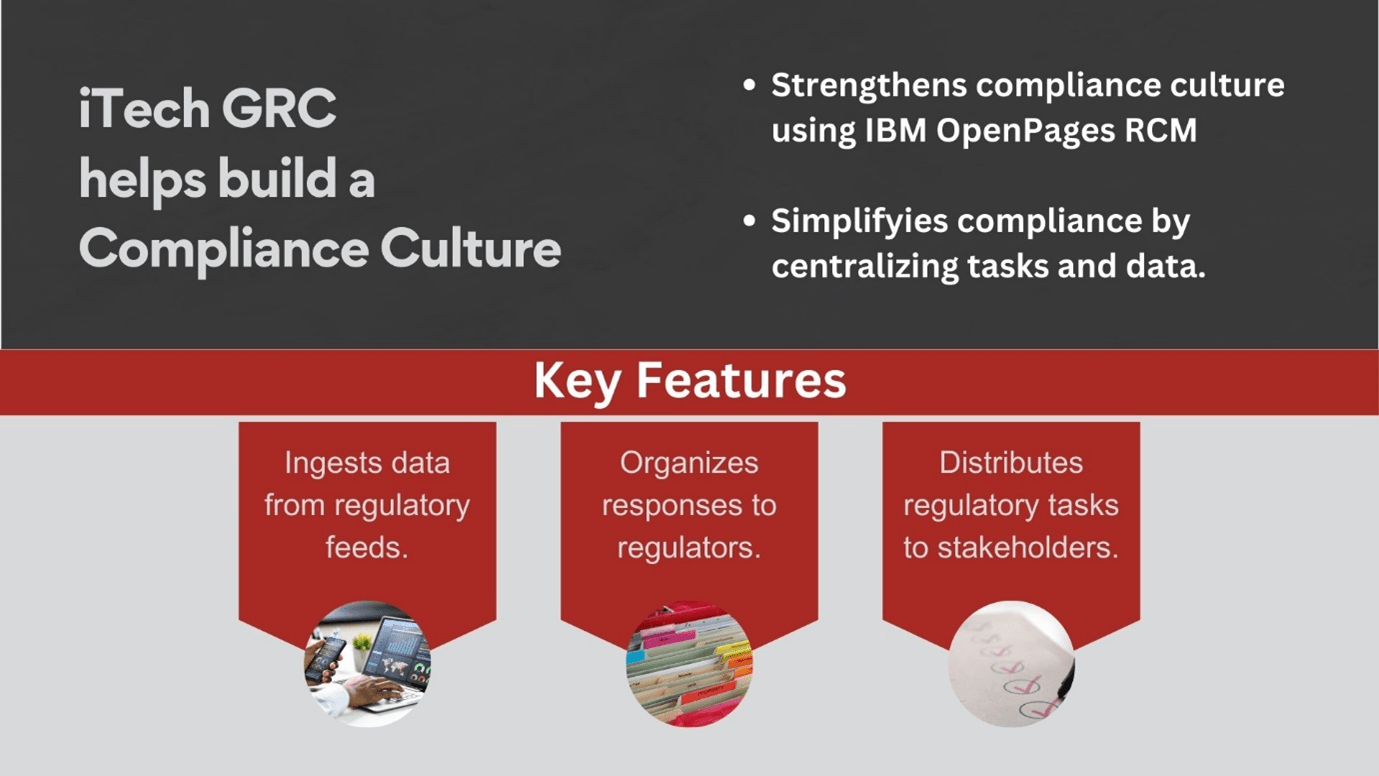

Compliance Software Companies, like iTech GRC, help build a Compliance Culture in Financial Institutions

iTech GRC helps financial institutions develop a strong compliance culture using IBM OpenPages Regulatory Compliance Management (RCM) solution. This software simplifies regulatory compliance by centralizing obligations, processing regulatory data, and automating tasks.

Key features include:

- Regulatory Feed Ingestion: Automatically processes data feeds from Thomson Reuters Regulatory Intelligence, Ascent, Wolters Kluwer, and Reg-Track.

- Regulator Interactions: Organizes responses to regulator inquiries and requests with easy workflows.

- Data Distribution: Assigns regulatory tasks to the right stakeholders, ensuring transparency and accountability.

Next Steps

Building a strong compliance culture is crucial for financial institutions to navigate the complex regulatory model and mitigate risks effectively. To further enhance compliance practices, consider the following steps:

- Conduct a Compliance Assessment: Evaluate your current compliance practices, identify areas for improvement, and prioritize key compliance risks.

- Implement Compliance Training: Regularly train employees on compliance policies, regulations, and best practices to ensure understanding and adherence.

- Enhance Regulatory Monitoring: Stay updated on regulatory changes and trends by leveraging regulatory intelligence tools and services.

- Strengthen Internal Controls: Implement robust internal controls to detect and prevent compliance violations, fraud, and misconduct.

- Foster a Compliance Culture: Promote a culture of compliance from top management to frontline employees, emphasizing the importance of ethical behavior and adherence to regulations.

- Utilize Compliance Technology: Leverage compliance software and tools, such as iTech GRC’s solutions, to streamline compliance processes, automate tasks, and enhance regulatory reporting.

- Regular Compliance Audits: Conduct regular compliance audits to assess your compliance program’s effectiveness and identify areas for improvement.

By taking these steps, financial institutions can build a strong compliance culture, mitigate risks, and uphold trust and integrity in the financial system.

Ready to revolutionize your financial institution’s compliance strategy? Please share your thoughts in the comments below or contact us today to explore how compliance software companies can transform your operations.