Final Rule Announced for SEC Climate-related Disclosures: What’s New in 2024

The world economy has reached a fair turning point after several long-drawn discussions about the impact of climate-related risks on investments. Recently, in the first week of March, the U.S. Securities Exchange Commission (SEC) announced a final rule to enhance and standardize climate-related disclosure for investors. The new amendments to the SEC climate-related disclosure rule will require details about registrants’ climate-related risks that have materially impacted or are likely to have a material impact on their business strategy, financial condition, or results of operations.

In the rest of this blog, we will provide a comprehensive overview of SEC climate-related disclosures and the purpose of the SEC’s rulemaking.

But first, here’s some background on SEC filings:

- SEC requires all publicly traded companies and other entities like insiders and brokers to disclose statements and documents periodically.

- The purpose of SEC disclosure is for regulatory compliance and to help investors and financial firms conduct due diligence on the companies’ performance for vetting financial instruments for investments.

- SEC filings can be accessed online at the Commission’s online database, Electronic Data Gathering, Analysis, and Retrieval (EDGAR).

- Investors commonly refer to SEC filings for valuations of financial instruments and assets portfolios. The filings include Form 10-K, Form 10-Q, Form 8-K, the Proxy Statement, Schedule 13, Forms 3,4, and 5, Form 114, and Foreign Investment Disclosures.

Investors, Public, & Publicly-listed Firms Need Climate-related Disclosures

Climate change is one of the most significant markers of economic growth and has far-reaching consequences on the global financial ecosystem. Besides biodiversity loss and critical damage to physical property, climate risks affect financial models based on climate-related variables. In other words, climate change drives physical conditions that reduce the productivity of economies, impacting the performance of stocks, bonds, and other financial instruments. Or they lead to transition risks, which involve regulatory changes and government decisions to favor sustainable alternatives and, in turn, drive investments out of carbon-intensive businesses.

Investors often push for transparency on climate related risks and their impact on a company’s business models, performance, risk management approaches, and their effects on financial statements. Shareholders are becoming increasingly concerned about climate-related risks. Leading companies such as Exxon Mobil, PPL Corporation, Chevron, and Occidental Petroleum recently came under shareholders’ pressure to provide transparency of their climate information and show accountability for carbon emissions. The carbon emissions and climate risk governance disclosures serve as qualitative metrics to measure a company’s potential financial impacts from climate-related transition risks.

A Harvard Business School study on shareholder activism and firm’s voluntary disclosure of climate change risks of S&P 500 companies found that the stock market responds favorably to the disclosure of climate change risks. Shareholder-induced disclosure benefits public companies as it provides investors with clear perspectives about climate change, reducing the uncertainty factor.

Data insights from a 2020 research also suggest that 75% of institutional investors attribute ESG ratings as a factor that influenced their voting and engagement activities. Additionally, ESG mutual funds are found to outperform non-ESG mutual funds 64% of the time.

These stats represent an undeniable narrative that corporate missions and declarations of their climate change and sustainability initiatives drive responsible investments.

Initial Rule Proposal for SEC Climate-Related Disclosures

On March 21, 2022, the SEC proposed its final rules to improve publicly listed companies’ disclosures related to climate-related risks and impacts. The proposals were built on the Task Force on Climate-related Financial Disclosure (TFCD) framework that requires companies to reveal their climate-related governance practices, risks and energy transition goals, and plans for meeting decarbonization targets.

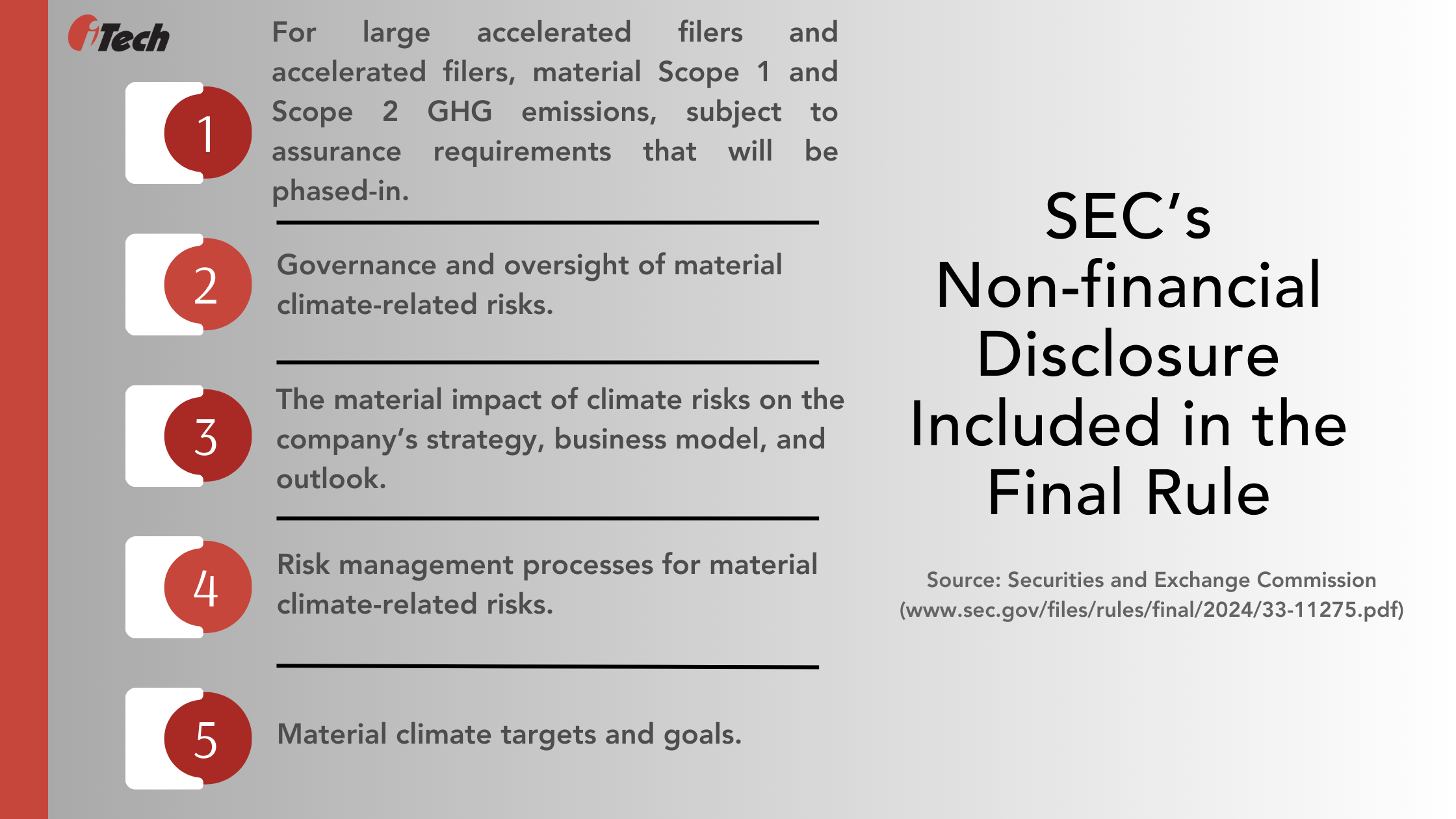

The SEC’s proposal included disclosures of financial statements such as financial impact metrics, expenditure metrics, and other information. The non-financial or climate-related disclosures included climate-related impacts on strategy, business model, outlook, GHG emissions reporting, governance and board of director’s oversight of climate related risks.

The initial SEC climate-related disclosures proposal set the context for companies to expect final rules and prepare for climate-related reporting compliance.

SEC’s Final Rule: Enhancement & Standardization of Climate-related Disclosures

Recently, with the SEC’s semi-annual update in December 2023, the Commission proposed adopting 25 rules and planned to finalize 22 by the spring of 2024. However, the commission delayed the action on the proposed rule given the resistance by public companies against some of the requirements, including Scope 3 greenhouse gas (GHG) emission disclosures, a 1% materiality limit for financial statement disclosures, and attestation of scope 1 and Scope 2 GHG emissions for large organizations.

The proposal for climate change disclosure is most awaited by institutional investors seeking more consistent, comparable, and reliable information on a registrant’s operations with precise reporting requirements. It includes several detailed, standardized, and prescriptive requirements for public companies to disclose reliable information to investors.

Initial Push Back by Public Companies

Many businesses and Republicans have challenged the Commission’s authority to prescribe rules. The U.S. Chamber of Commerce also privately mentioned filing lawsuits when the SEC rules are finalized. The Commission reportedly received about 24,000 comment letters and 4,500+ unique letters in response to its proposal rule issued in March 2022.

On March 6, 2024, the SEC issued the final rule on climate-related disclosures outside of financial reports. The new rulemaking agenda led by SEC’s Chair, Gary Gensler, is welcomed by investors and others who reportedly had concerns and sought clarity regarding the extent, cost, and feasibility of proposals. The new rule includes critical changes and excludes a few from the proposed rule.

The final rule requires registrants to provide climate-related disclosures in their annual reports, registration statements, and IPOs for the annual year ending December 31, 2025. Chair Gensler added in a statement, “The final rules will provide specificity on what companies must disclose, which will produce more useful information than what investors see today. They will also require that climate risk disclosures be included in a company’s SEC filings, such as annual reports and registration statements, rather than on company websites, which will help make them more reliable.”

The Commission’s new rule includes the disclosures outside financial statements.

Critical Changes in Final Rules on SEC Climate-related Disclosures:

- Establishing a materiality threshold for Scope 1 and Scope 2 GHG emissions. And registrants or public companies delay the disclosure of Scope 1 and Scope 2 information, and any related attestation, by allowing them to submit it by the due date of their second fiscal quarterly report for the following year.

- Giving the registrants full flexibility in determining the organizational boundary for their Scope 1 and Scope 2 GHG emissions along with relevant disclosure on how the boundary varies from the scope of the consolidated financial statements.

- Removing the Scope 3 GHG emission disclosure requirement.

- Elimination of the requirement for the evaluation of the financial statement impacts on a line-item-by-line-item basis and rather than requiring disclosure of amounts reflected directly in the financial statements when the aggregate amounts exceed 1% of their pretax income or total shareholders’ equity, subject to a de minimis limit.

- Increasing the adoption timeline, giving large, accelerated filers nearly (1) two years to provide most disclosures, (2) three years to share the GHG emission information and certain other disclosures, and (3) six years to receive limited assurance over GHG emissions.

- Exempting smaller reporting companies (SRCs), emerging growth companies (EGCs), and nonaccelerated filers from providing GHG emission disclosures and related attestation.

Organizations Must Adopt Iterative Approaches to Grasp Regulatory Requirements

With the acceleration of technological innovations and geopolitical tensions, the global banking, financial services, and insurance (BFSI) sectors are fraught with polarizing narratives about investment opportunities. On one end, there is no shortage of concerns about climate hazards and its long shadow on economic growth. On the flip side, the urgency to transition into sustainable alternatives promises lucrative investment prospects that outweigh the long-term impacts of climate-related risks. While efforts are made to rope in climate change in investment beliefs, both public companies and investors also need iterative technological and compliance approaches to accommodate for changes to the SEC’s rules for climate-related disclosures.

At iTech GRC, we help leading enterprises and financial companies accurately and comprehensively assess their regulatory compliance risks. Leveraging IBM’s OpenPages Regulatory Compliance Management (RCM) solutions, we guarantee the automation of tasks to recognize and implement regulatory changes and their relevant requirements to keep up with GRC objectives.

Contact our experts to start the conversation to build a transparent, actionable regulatory compliance management process and systems while saving your organization’s compliance costs and efforts.

(For more information visit: SEC Final Rule Release No. 33-11275, The Enhancement and Standardization of Climate-Related Disclosures for Investor

SEC Proposed Rule Release No. 33-11042, The Enhancement and Standardization of Climate-Related Disclosures for Investors)