Automated Risk Assessment: Monitor Your Business Risks 24*7

Modern businesses face many risks, from cyber threats to financial crises, and risk management is not merely important; it is critical to staying alive in this competitive environment. According to a study by AICPA and NC State University, 65% of senior finance leaders agree that the volume and complexity of corporate risks have changed “mostly” or “extensively” over the last five years. With this evolving nature of business risks, automated risk assessment becomes essential for survival and success.

Automated risk assessment systems act like high-tech tools, like those in the movie, predicting and dealing with risks efficiently and reliably.

In this post, you’ll learn how automated assessments improve risk detection, save on costs from automation, and improve compliance and security through consistent assessments.

Risk Assessment in Today’s Business Environment

Risk assessment forms the base of any strategic decision-making. Just as a seasoned intelligence agent makes his way through the provided data to determine the magnitude and nature of threats, businesses must analyze potential risks in detail, having the fullest possible information on them.

Major Types of Business Risks:

- Financial risks: It includes financial stability risks for market fluctuations, liquidity concerns, and credit risks.

- Operational: These are the risks that result from day-to-day operations and might include supply chain breakdowns and internal fraud, among others.

- Reputational Risks: These arise from customer dissatisfaction; whereby negative public exposure may damage the firm’s good reputation.

According to PwC, 35% of risk executives identified compliance and regulatory risk, along with other operational risks, as the biggest threat to their company’s growth. Taking big risks can be quite exciting, but most of the time, they may lead to failure, especially in business risks. Having a great risk assessment plan can be very worthwhile.

Risks are normally not perceived to be good, and they can get worse when there is so much at stake and little room for errors. That’s where automated risk assessment helps a lot. Businesses can only grow and remain stable by dealing with threats before they develop into big problems.

Now that the importance of risk assessment has been presented in today’s business environment, we will examine the details of automated risk assessment systems and how they can revolutionize this process.

What Is Automated Risk Assessment?

Automating risk assessment is a subtle process that uses high technologies to identify and handle risks most effectively. Automated systems in risk management help predict possible risks in an organization by understanding the risks through data analysis, machine learning (ML), and artificial intelligence (AI). These present the fundamental perspectives of how business operations are undertaken, and organizations could obtain valuable insight from them to avoid possible risks resulting in undesired outcomes.

Many companies are adopting automated risk management into their GRC (Governance, Risk, and Compliance) programs and digital transformation initiatives.

The global risk management market is experiencing significant growth. It is projected to reach USD 35.9 billion by 2032, with a 13% growth rate from 2024 to 2032. Similarly, the risk management software market, valued at USD 31.33 billion in 2021, is expected to reach USD 35.01 billion by 2029, with a 9.75% growth rate during the forecast period.

Critical Aspects of Automation in Risk Assessment:

- Data Collection: Data collected by the automated risk assessment system will find sources from transaction logs, network logs, employee information, and market trends. These shall provide data of great relevance in the context from which risk may develop.

- Data Analysis: The analyzed data will be processed through an advanced algorithm. The machine learning algorithm could predict significant patterns, trends, or anomalies for further occurrence. Then, the most accurate risk evaluations are made according to historical data and the time trend.

- Risk Assessment is a process through which the data system identifies the risk regarding potential impacts and the likelihood of occurrence. This is mainly done through simulation, which models various scenarios to understand likely outcomes.

- Mitigation Strategies: From the criticality analysis, the system gives the entity some recommendations on what might be needed to mitigate the risk. This may include putting certain controls in place, changing processes, or transferring risk to insurance or other parties. These recommendations are then ranked based on the severity of the risk and the cost-benefit of the mitigation strategy.

- Monitoring and Reporting: Automated risk assessment systems constantly monitor data and risk indicators to identify new or fast-evolving risks. These also allow for generating reports that would otherwise not be possible to produce manually, reporting up-to-date information on an organization’s risk profile and how effective the put strategies are for dealing with the put risk.

- Integration with Business Processes: For it to succeed, an automated risk assessment system should merge well with the already existing business processes. This ensures that the risk assessment is done in real-time, and hence, mitigation can be done on time, or rather, promptly, with both effectiveness and efficiency.

- Compliance and Regulatory Needs: Automated risk assessment systems allow the organization to align by identifying and managing risk according to regulatory compliance. They can even generate compliance reports for regulatory authorities.

- Scalability and Flexibility: Automated risk assessment systems are designed to keep a view of scalability and flexibility so that they can adapt to any changing risk domain and the organization’s business environment. It can handle large volumes of big data and be scaled to suit the unique needs of industries or any specific organization.

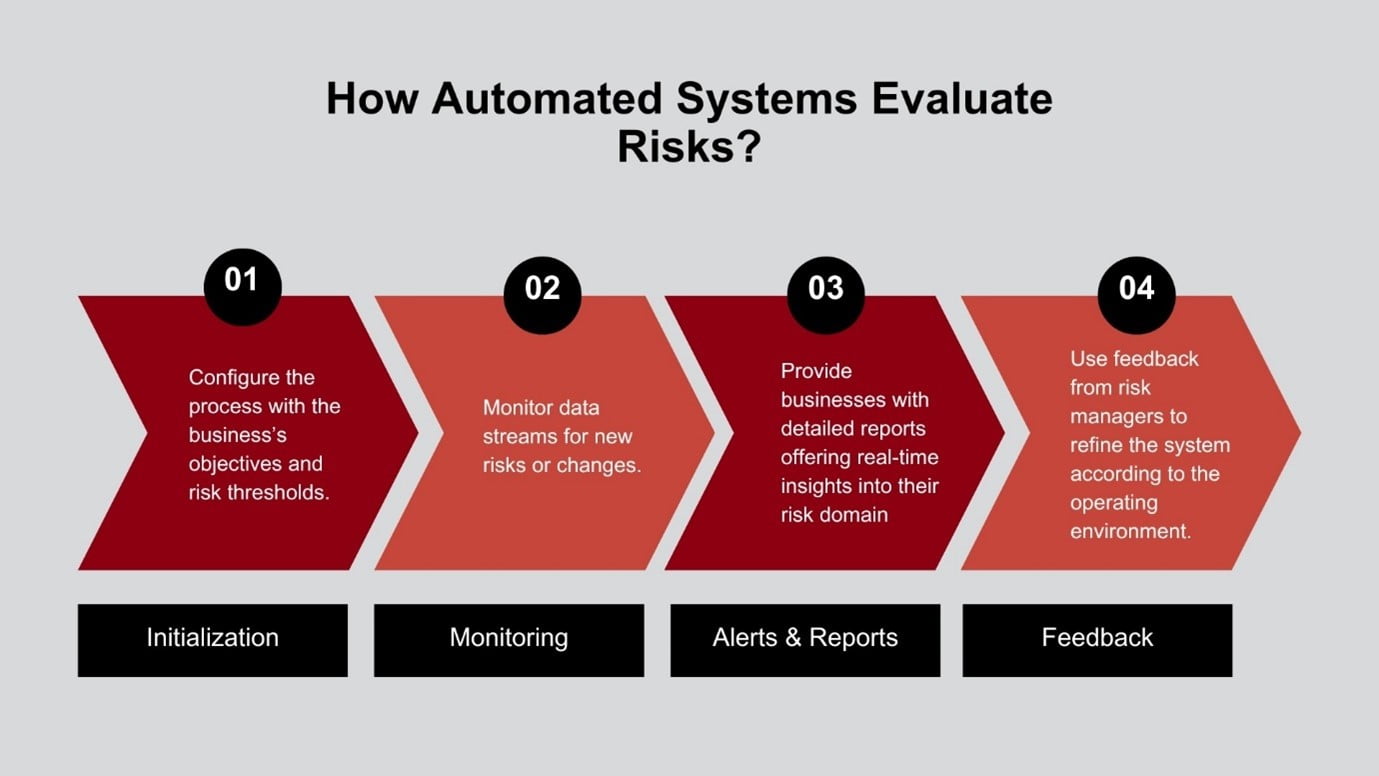

How Automated Systems Evaluate Risks?

- Initialization: Configure process indicating business objectives and risk tolerance.

- Continuous Monitoring: Data streams are monitored for newly surfacing risks or changes.

- Alerts and Reports: Offer businesses detailed reports that provide real-time insights into their risk domain.

- Feedback: Refinement based on the operating environment using risk managers’ feedback.

Benefits of Automated Risk Assessment

Transitioning from manual risk assessment to an automated system is a revolution in risk management for every business looking for operational efficiency and strategic relevancy. And here is why:

- Faster Risk Assessments: Risk assessment processes get accelerated by the automation of fetching, processing, and analyzing data. Therefore, organizations can do their risk assessment more often than they do and subsequently make decisions more quickly.

- Better Data Accuracy and Consistency: Automation reduces the number of human-caused errors during risk assessments. It uses algorithms and data analytics to make assessments based on objective and reliable data.

- Real-Time Risk Insights: Tools enabled with automation can provide on-the-spot data and insights, allowing the organization to act promptly when new and shifting risks occur.

- Comprehensive Data Analysis: Full automation of thorough analysis of extensive volume data to clearly understand potential threats.

- Improved Risk Prioritization: An automated system can help an organization handle the most critical risks more efficiently when all risks are classified in terms of severity, impact, and likelihood.

- Customization and Adaptability: Automation tools can be adapted to meet the needs of particular industries and fit different risk and standard models.

- Scalability: Automated systems can handle larger datasets and assessments as organizations grow without more resources.

- Cost Saving: Though automation demands a front-loaded expense, it ultimately pays you back in terms of the savings accrued from the labor work and human errors that are eliminated.

- Improved Decision-Making: Automation provides timely and accurate information that empowers the organization to develop confident strategies during the decision-making process.

- Competitive Advantage: The automated assessment of risks permits the firm to react much more quickly to opportunities, gaining the organization a competitive advantage.

This, therefore, implies that the integration of automated risk assessment better equips the company against potential threats, thus saving them operational costs and aiding them in better compliance management. It is an investment that helps protect businesses against the unpredictable threats they face in the modern business environment.

Before we get into the concluding part of this piece, let us examine some of the common pitfalls of the organizational risk management process and how the organization should avoid them.

Common Mistakes Made in Risk Management

Sometimes, organizations need help to utilize the implemented risk management solutions properly. Instead, they opt for legacy or manual systems, completely bypassing modern solutions that include AI and data analytics capabilities. Understanding why these decisions are made and the challenges faced is a core part of managing risk effectively.

- Suitability of Solutions:

- Size and complexity: The number and type of risks will differ according to the size and complexity of the business. Smaller firms might rely on traditional methods like spreadsheets. For large companies with global operations and complex products, automated solutions in risk management are essential.

- Cost Concerns:

- ROI Calculation: Estimating the return on investment (ROI) for a risk management solution can be challenging but is crucial. Specialized features may come with poor integration with other enterprise systems, limiting the visibility of risks across the organization and hindering the realization of benefits.

- Maintenance and Upgrades: Risk management systems require regular updates to stay effective. However, the associated costs can be significant, especially for smaller organizations. This cost factor may discourage the use of modern risk management solutions.

- Training and User Adoption:

- Software Complexity: Despite being designed to be user-friendly; risk management software has inherent complexities. Employees need substantial training to use it fully and optimally.

- Ongoing Training: Training must continue, especially with each software upgrade and as new employees join the organization. Inadequate training can lead to underutilization and decreased software effectiveness.

- Data Security:

- Importance of Secure Data Management: Since risk management heavily relies on data, securing access to this data is paramount. Any breach of the risk management information system can compromise sensitive data, such as employee and customer data, and lead to non-compliance with regulatory requirements.

In essence, a better understanding of these common mistakes and challenges in risk management would enable organizations to make wiser decisions and better benefit from modern solutions, thereby enhancing efficiency and effectiveness in managing risks.

Final Thoughts

Warren Buffett once said, “Risk comes from not knowing what you’re doing.” Uncertainty can be a problem for any business; however, given the proper tools and strategy, the latter can face it confidently.

iTech delivers a range of professional services in Integrated Risk Management (IRM), all provided under IBM OpenPages GRC solutions. Their advisory services cover the methodology of identifying risk and designing a solution that increases security measures.

iTech GRC also caters to a broader scope of managed services aimed at propelling your risk management capabilities, covering from implementation services that ensure rapid deployment of IRM solutions, installation of IBM products and modules, to follow-on maintenance support using methodologies of ITIL, coupled with over 95% rate user satisfaction users are guaranteed ongoing support.