Greenwashing, U.S. Elections, & Anti-ESG Movement: What’s Brewing in 2024

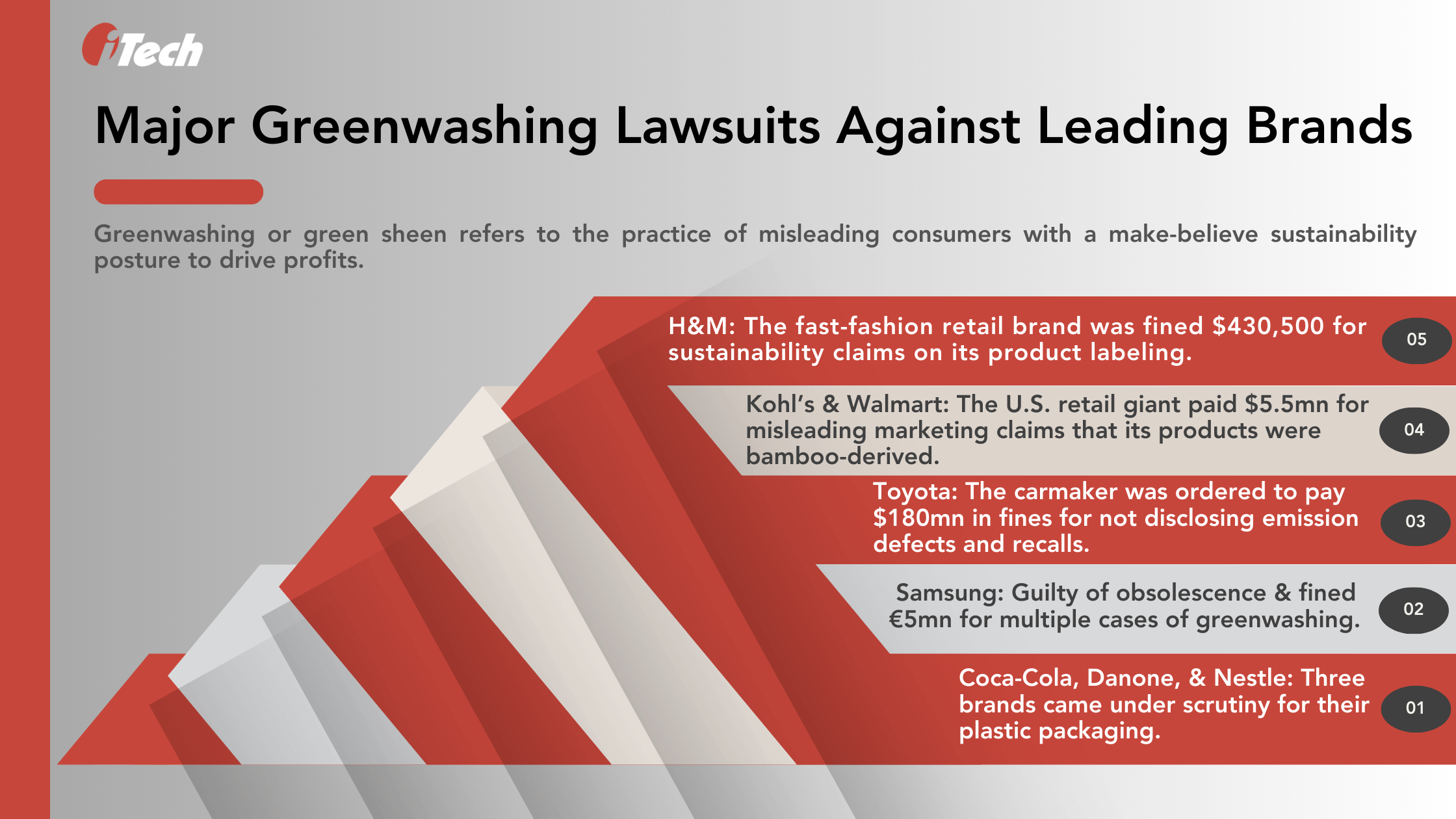

Events on the global regulatory front in 2023 turned environmental, social, and governance (ESG) into a serious boardroom agenda. Concurrently, there are businesses playing along the sustainability lines by wrongfully claiming and marketing their products and practices as ‘sustainable’ and ‘eco-friendly’. The practice of misleading consumers with a make-believe sustainability posture to drive profits is called greenwashing or green sheen.

Here’s some startling stats on greenwashing:

- Nearly 68% of U.S. executives reportedly admit that their firms are guilty of greenwashing.

- Website screening for greenwashing revealed that 42% of green claims were found to be exaggerated, fake, and deceptive.

- 58% of global C-suite leaders admit to greenwashing.

Ironically, as regulators and consumers turn sustainability vigilantes, 70% of business executives in the U.S. associated with the Republican party are criticized for their ‘woke’ or pro-ESG philosophies. South Carolina lawmakers are hellbent on proposing that investments must be pulled off from companies that would consider ESG factors in their investment strategies. The removal of $200 million worth of investments from BlackRock incited backlash against big financials for using investments to promote a liberal agenda.

The critics’(Republicans) argument against the ESG movement prescribes business leaders to embrace a ‘capitalistic and shareholder-centric’ approach where the end goal is profits and investor funds. The anti-woke or ESG agenda opposes screening companies against their ESG-related risks for investment decisions. The polarization of ESG legislation with anti-sustainability rhetoric in Republican states will further the barriers to understanding greenwashing risks by local businesses.

For the 2024 U.S. election cycle, there is heightened influence and focus on sustainability activism, law enforcement, and consumer or stakeholder advocacy on ESG. Industry experts warn that greenwashing and related lawsuits will significantly affect geopolitics and this year’s November presidential elections.

In the rest of this blog, we will get a deeper overview of greenwashing and the corresponding regulatory measures for business leaders and fund managers to take note of to mitigate non-compliance risks.

Need to Please New Age Consumers Linked to Greenwashing

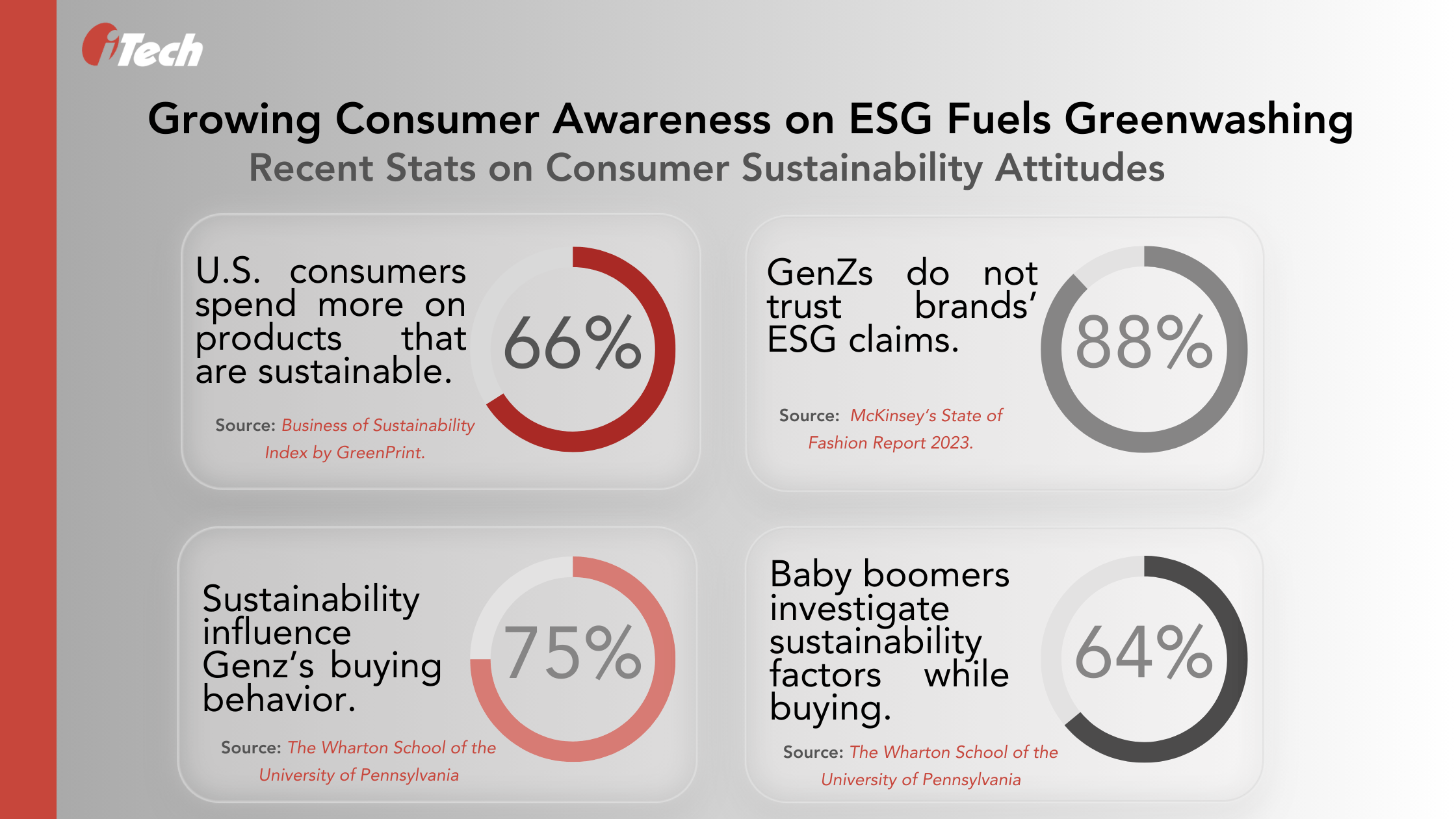

After the Paris Agreement, several countries pledge to reach net-zero goals by 2050 to lower temperatures by 2 degrees Celsius. The push towards lower GHG emissions and disclosures intensified at federal, state, and global levels. The U.S. Securities Exchange Commission (SEC) recently announced the proposal for new climate-related disclosures and is currently reviewing public and stakeholder comments for rule finalization. Many corporations worldwide fabricate evidence of their environmental impact as more consumers are concerned about the environment and ethical corporate practices. On average, U.S. consumers spend $14 trillion annually, which is over 70% of the nation’s GDP. 66% of U.S. consumers and 80% of young adults will pay more for brands that sell sustainable products!

The pressure to satisfy today’s consumers doesn’t end there. The importance of sustainability is relative to consumers’ age. According to the U.S. Consumer Attitudes on Sustainability Shopping, 75% of GenZ consumers investigate sustainability factors while buying a product, compared to 64% of consumers from the baby boomer generation.

McKinsey’s State of Fashion 2023 report reveals that 88% of GenZ consumers do not trust brands’ ESG claims. Other research found that customer satisfaction levels of companies charged with greenwashing lawsuits dropped by 1.32%.

Global Regulatory Standards for Greenwashing

To prevent greenwashing, the U.N. Secretary-General established a High-level Expert Group to develop stronger and more comprehensive standards for corporate, banking, and financial institution net-zero commitments, cities, and governments. The Group, which was tasked by the U.N., announced ten recommendations in the Integrity Matters Report for building on credible existing initiatives and tight definitions of net-zero.

On June 5, 2023, the UN Climate Change published a Recognition and Accountability Framework, Draft Implementation Plan to improve the credibility of climate actions and pledges. The draft focuses on enabling actions that follow the recommendations provided in the Integrity Matters Report.

How are the U.S. Legal Frameworks Tackling Greenwashing?

In comparison to Europe, regulations in the U.S. for greenwashing are less advanced. However, the SEC’s new rule proposals are some of the actions underway. In September 2023, the SEC replaced the ‘Name Rule’, requiring about 80% of the businesses’ investment portfolio to match its deemed assets. SEC’s Chair Gary Gensler said, “A fund’s investment portfolio should match a fund’s advertised investment focus,” said at the SEC’s meeting to finalize this rule. Such truth in advertising promotes fund integrity on behalf of fund investors.”

Since 2021, the SEC has also taken measures with the launch of the Climate and ESG Enforcement Taskforce. The initiative works to proactively identify and prosecute defaulters for misrepresenting their ESG investment practices. The Taskforce also examines ESG disclosures and compliance related to investors’ advice and strategies for funding sustainable investments.

In October 2023, the SEC announced more stringent reporting standards that would slow the development of new ESG funds. The Commission’s recent proposals for new rules on climate-related disclosures, with an exclusive focus on reporting guidelines and GHG emissions, will be finalized in 2024.

In addition, state consumer protection laws are expanding to include greenwashing liabilities. The Federal Trade Commission (FTC), with its regulations to protect consumers and ensure an ethical marketplace, also created voluntary guidelines to help companies differentiate companies with greenwashed products.

Uncovering Some of the Biggest Greenwashing Lawsuits

In North America, 72% of companies engage in corporate greenwashing, 24% higher than the global average. Greenwashing activities by global banks and financial firms increased by 70% over the last two years. Almost in 50% of those instances, banking firms were reportedly linked to oils and fossil fuel providers, defying their ESG claims. Let us investigate some of the biggest greenwashing penalties imposed to date.

DWS, the investment firm managing Deutsche Bank (DBKGn.DE), was fined $25 million for misstating its ESG investments. Once marketed as a leader in ESG investing, DWS underdelivered on building a mutual fund anti-money laundering program. After a two-year probe, the firm concluded that it engaged in green washing.

The SEC issued a cease-and-desist order and penalty of $1.5 million to BYN Mellon Investment Adviser to resolve matters concerning ESG investment policies for six mutual funds managed by the firm. Goldman’s Sachs Asset Management also faced a penalty of $4 million to settle charges for not having written policies and procedures for ESG research for use by its investment teams between April 2017 and February 2020.

The rest of the greenwashing instances are outlined below:

Impact of Greenwashing on Geopolitics and U.S. Elections in 2024

In 2024, some of the largest democracies will have elections that will have a long-term influence on the global economies, energy prices and supply chains, and trade negotiations. The U.S. is already caught between political crossfires from evolving regulations on AI and sustainability actions and opposition against these laws.

In 2023, many U.S. states independently adopted ESG legislation. California adopted climate change disclosure, while attorney generals of states like Florida, Kansas, Idaho, and Texas hesitated regarding ESG matters. After a flurry of sustainability-related regulations, new rhetoric has emerged to backlash against the ESG agenda with an anti-woke or anti-ESG approach. Many states are divided by their pro- or anti-ESG legislation belief.

2024 is predicted to be more eventful, with U.S. presidential elections, ongoing ESG tensions, Russia-Ukraine conflicts, unrest in the Middle East, and global elections. These will all impact ESG developments and global corporate priorities.

The takeaway for the year is that ESG-related enforcement, with a narrowed focus on greenwashing and government enforcement and its political contributions, is driving the need for detailed reporting standards.

In the meantime, iTech GRC’s specialized experts can help enterprises make the most of the IBM OpenPages platform to address their Regulatory Compliance Management and ESG programs. We believe in assisting organizations in building a risk-aware culture to comply with the latest sustainability regulations and fulfill GRC goals.

Connect with our team to know more about iTech’s GRC solutions.