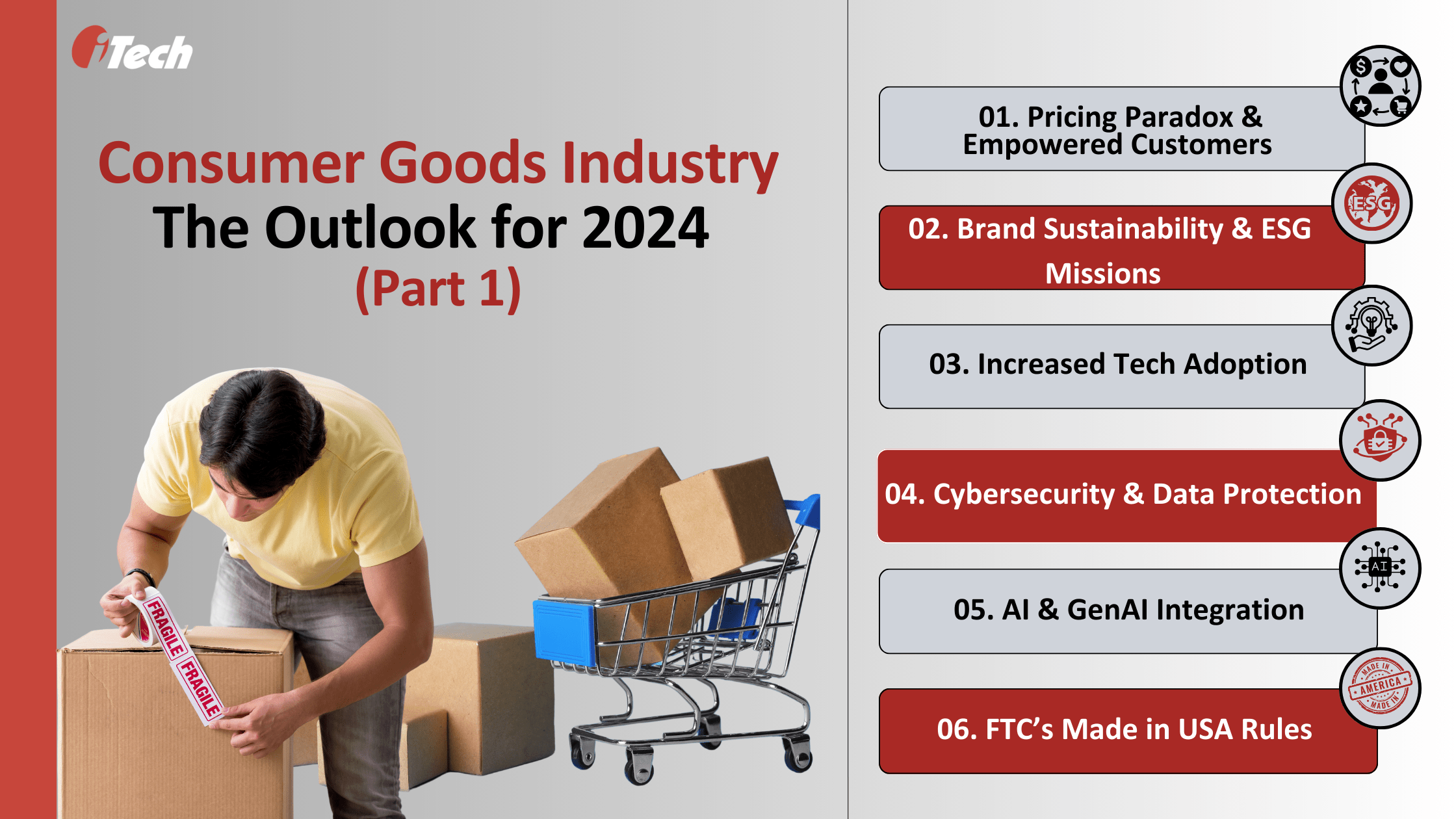

2024’s Top Risks in the Consumer Products Industry (Part1)

Tumultuous global and economic events from previous years will likely persist in 2024. Therefore, the severity of the risk in the consumer products industry will be amplified. As this landscape evolves with pressing prioritizing for product innovation and customer-centricity, profitability may not be the silver lining that consumer products companies hope for.

Why? The risks impacting this industry are systemic, dynamic, and interconnected!

In part one of the blog series, we will dissect the state of the consumer goods industry in 2024. We will also understand the key risks and trends that will collide with the U.S. consumer product manufacturing companies’ governance, risk, and compliance (GRC) goals and strategies.

At iTech GRC, we enable firms to have an accurate and comprehensive overview of the regulatory compliance risks and manage supplier risk management strategies using the IBM OpenPages platform. To adopt a resilient approach towards GRC frameworks and strategy, our GRC experts believe in sharing timely insights to stay closely aware of the risk landscape.

Consumer Goods Industry Overview: Pricing Paradox & Era of Empowered Consumers

Historically, consumer product companies have used price increases to increase revenue and profitability. Last year, rising prices contributed to a 10% increase in global sales growth. However, today’s inflationary economy discourages hiking up prices and requires an intelligent balance of cost, ideal unit volume, and product innovation to hit profit margins.

Recent market observations reveal interesting trends that challenge the notion of price-centricity as a profitability driver. The long-term profitability and growth of a consumer products company are tied to its positive impact on all stakeholders (consumers, customers, employees, and the environment) and not just shareholders. Below are the factors influencing pricing in 2024:

- Global Economic Outlook: The global economy is still coping with inflation, which has seemingly stabilized at 4.9% in 2024 compared to 6% in 2023. However, it remains higher than pre-pandemic levels of 2.7%. Flexing prices to cover high input costs, supply chain disruption, and increased raw material costs has led to a downward impact or pricing paradox.

- Supply Chain Crisis: Almost 90% of traded goods are shipped globally. Climate change, geopolitical conflicts in the Middle East, the Red Sea crisis, and drought in the Panama Canal have disrupted the supply chain, its operational margins, and shipping costs during a period of high demand, impacting consumer products companies.

- Consumers are Against High Prices: Recently, Deloitte conducted a survey analysis on the 2024 Consumer Product Industry Outlook that involved 100 publicly listed consumer product companies. The surveyed executives from the consumer product firms revealed that consumers are unwilling to pay high prices, posing a significant issue in 2024. Consumers’ expectations of more value for high prices are driving them to discover affordable brands or alternatives promising greater consumer value.

- Retailers’ Resistance Against Price Increase: Retail companies increase prices to counter inflation, but Deloitte’s survey data found a reverse trend. 40% of surveyed participants mentioned the possibility of strong resistance and pushback by retailers against price increases this year.

- Stiff Market Competition: Consumers find alternatives to combat price inflation. New market entrants and options increase competition for consumer product companies. 70% of surveyed consumer product companies’ executives believe fast-food and quick, over-the-counter (OTC) service companies are competing with food and beverage products companies.

- Increased Marketing Spend: Over 70% of consumer product companies will boost marketing and advertising investments. The same percentage of surveyed respondents expressed prioritizing investments to market their flagship brands over new brand launches to balance pricing.

- Product Premiumization & Innovation: Nearly 80% of executives from consumer product companies plan to increase product innovation investments to keep up with the innovation agenda pending since the COVID-19 pandemic. Among product innovation strategies, product premiumization, net-new innovations, and sustainability will command high prices and consumer interest.

- Profitable Volume Strategy: Decision-makers and C-suite leaders will shift towards profitable volume, wherein consumer product companies will focus on increasing their sales units to increase revenue and profitability. This requires a meticulous balance of price, marketing, and innovation optimization.

Sustainability & ESG Practices Take the Centerstage in Consumer Products Industry

The consumer products industry is at the inflection point of several sustainability transitions and ESG initiatives. In the wake of unprecedented climate change and parallel social justice movements, inaction, and complacency can result in legal repercussions for consumer products companies.

- Consumers Favor Conscientious Brands: According to the PwC Consumer Intelligence Series, 76% of consumers are willing to sever ties with companies that treat the environment, employees, and the community poorly.

- Regulatory Agencies Amp-up Pressure: Global regulatory agencies are hastening the adoption and prioritization of ESG practices spanning important topics like greenhouse gas (GHG) emission targets, responsible production, recycling, and disposal, and diversity, equity, and inclusion. These themes matter to the consumers, regulators, employees, and society.

- Greenwashing Surveillance Continues: FTC’s Green Guides issued to check misleading sustainability and eco-friendly claims in product labeling, branding, and marketing strategies will prevent companies from making greenwashing errors.

- SEC’s Climate Disclosure: In 2024, consumer product companies will dedicate their time and resources to accommodating the SEC’s new rule for climate-related disclosures and the E.U. Corporate Sustainability Reporting Directive (CSRD).

- ESG & Sustainability Drive Purchases: Consumer product companies will continue to approach sustainability and ESG strategies as opportunities to drive consumer purchases and employee engagement.

Increased Tech Adoption

In today’s hyper-digital age, the consumer landscape has evolved significantly, which requires ditching traditional approaches for customer data, behavior analysis, and omnichannel engagement. According to the Harvard Business Review, digital maturity in the consumer product industry lagged at the early stage of transformation. Consumer product companies are investing in technologies and data strategies that help them deliver seamless digital experiences and other innovative offerings.

- First-party Data-Power Loyalty Programs: Retail brands leverage consumer data to earn customer loyalty in an era of shifting prices and a spiraling economy. Forrester’s insights reveal that only 7% of online consumers are signed up for loyalty programs by consumer product brands. Although this industry is far behind in innovation, renowned brands are catching up to optimize first-party consumer data to build loyalty programs.

- Brick and Mortar to Digital Experiences: Many brands are implementing augmented and virtual reality (AR/VR) experiences for consumer-product interaction. From online order management to personalized marketing outreach, consumer product companies will harness AI and GenAI capabilities in 2024.

- Digital Transformation Investments: According to McKinsey’s research, brands in the consumer goods industry that invest in digital innovations bring products to market 50% faster, with one-third lower cost and a twofold increase in ROI. Recent examples of consumer product companies embracing digital strategies include Mercedes-Benz Group, which has digitized its entire product development and production ecosystem.

Cybersecurity & Data Protection

An IBM study confirms that 44% of data breaches targeted personally identifiable information like name, email address, and passwords. Another study by KPMG revealed that 60% of consumers believe that businesses routinely misuse their personal data. Consumer product companies must safeguard customer trust while delivering digital, omnichannel experiences.

Additionally, emerging threats from cybersecurity incidents and events that compromise data privacy emphasize prioritizing data protection, banning the sale to third parties, and stronger approaches to third-party risks. SEC and other statutory guidance on cybersecurity disclosures and IT risk compliance.

AI & GenAI Integration

Integrating AI and GenAI is the next big shift in the consumer products industry. It will help businesses adopt automation and productivity innovations in labor-intensive areas. AI and GenAI-led tools and capabilities in consumer—and employee-facing areas guarantee improved engagement, satisfaction, and experience.

According to Gartner’s research, nearly 24% of consumer goods marketing technology leaders are investing in GenAI, and 60% are planning to invest by 2026.

On the business side, these technologies are revolutionizing decision-making, demand forecasting, and product innovation using predictive analytics, business intelligence, and real-time data insights.

However, the U.S. must wait a long time to finalize a common AI regulation to avert lawsuits and non-compliance risks for using unfair and unethical AI models.

FTC’s ‘Made in USA’ Labeling Standard

Many consumer product companies have co-manufacturing contracts to help them meet production volume and capacity. These contracts come with an independent set of regulatory and legal requirements. The Federal Trade Commission (FTC) Made in USA standard and disclosures have strictly monitored consumer product manufacturers since 2021 against false claims and other violations.

Early this year, the agency slapped a $2 million fine on a consumer product manufacturer for wrongly labeling Made in USA for products that were manufactured overseas. The FTC will continue to regulate the consumer product industry and marketers against unqualified claims and labeling.

Stay tuned for part two to explore legal risks surrounding the U.S. consumer products industry in 2024.

Are you looking to connect with our certified GRC team to optimize your enterprise’s investment in IBM OpenPages with Watson?

Contact us today!